Stock Picks, Analysis and Education

[ Dow Jones | S&P EMini | QQQQ | Forex | PHW Stock Selection ]

Date: 01/06/2014

- To license any of the indicators shown in charts below, click here.

Click Here to view the past issues for FREE

Market Commentary

Second Correction Is Approaching. The Dow Jones has extended just past the 23.6% extension line from the last high at 16,133. Yesterday and today the correction began from the high of 16,588 and is now back down touching the Attractor at 16,456. That shows that a correction is indeed in order back down to the 16,133 area. It's not a big correction that's impending, but an important one. The impending correction will scare a few people out of the market, as doomsayers always poke their heads out preaching fear whenever a correction starts. But, I think the market will bounce right back up into the 17,000 area as soon as the 16,133 Attractor is hit. I expect a bit of bouncing around as the market heads into the correction.

What to do? As for me, I'm taking profits now and waiting for better prices to buy back in.

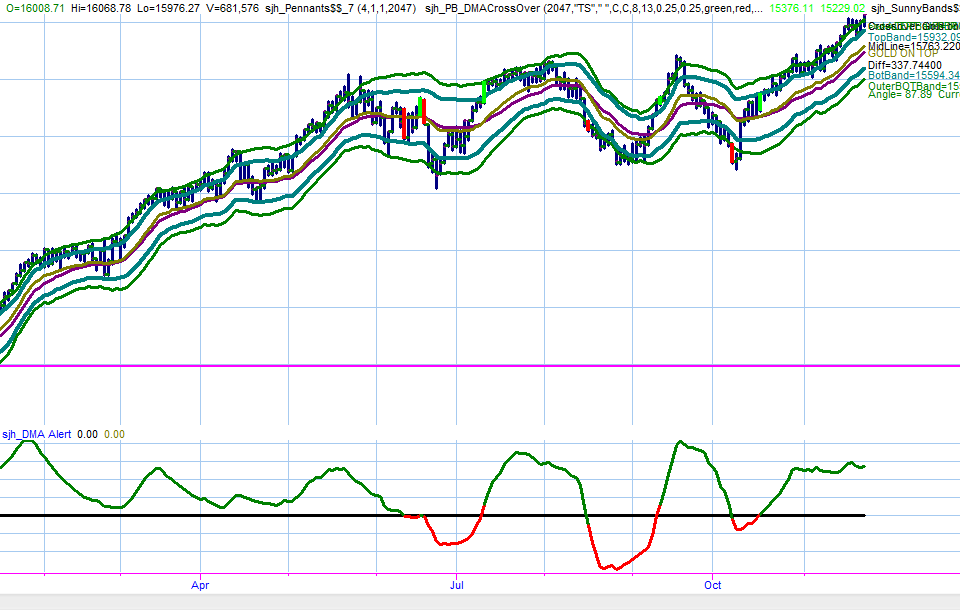

EMini has begun. You can see from the above chart that the DMA has been breached to the downside. The move down began before the corresponding move in the Dow, so the EMini is ahead. Price almost touched the Midline of the SunnyBands (aka the DMA), but didn't quite make it. So, I expect a retry to the downside in order to actually touch the Midline. In fact, I expect price to dip down to the Inner Lower Band, which lies at 1793 before the move down is over.