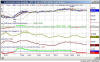

What a sideways, little, go-nowhere day. Hindsight tells us that the only move for today was to get chopped up--and that's what we did. We got a short signal in the middle of the day (emailed at 10:15aPT), but I didn't like it because RSI was holding above 40. Had RSI broken 40 it would have been good to go short, but it never did on the 15-minute chart.

Our 15-minute model has been long the SPY since 8/142002 at 11:15aPT. Like the other indexes, it looks like it is about time for some profit taking; but, don't take it all off the table just yet.

The Bollinger Bands are narrowing, showing congestion (and indecision) are about to happen.

My Pennants indicator has a pennant top at 94.55, which is where it would be a good idea to set a profit taking stop, just incase the market starts a correction. If we're going on up, the SPY will bounce off that line and continue on upward.

Boy, 9000 on the Dow sure looks "attractive." In fact, that's where our Attractor is, at the very powerful 9000 number. We almost made it today by reaching 8993.98, putting us only 6+ points away. The big question is what will happen when we hit 9000? Probably more bumping & grinding. That's usually what happens at key numbers like that. So, look for several choppy days as we maneuver around the 9000 level.

On the daily DIA we are facing an sjhAttractor that lies at 90.15; we almost made it today--going as high as 90.13. The 90.15 Attractor comes from November 2001, followed by lots of playing in that area in June 2002. Whether we will reflect off that level, or charge on through it to the next Attractor remains to be seen. It's about time for some mild retracement, but we may go on up to the next Attractor at 92.30 before retracing.

Our 15-minute model went long on 8/14/2002 at 11:30aPT, and is still long. It's is time to consider taking some profits off the table, as RSI is holding above the 65 line and we are slightly backing off from the upper Bollinger Band.

Stay nimble.