|

NOTE: As a Platinum Zone member, you may call

Sunny at (760) 930-1050 if you have any questions about terms used herein.

Commentary

TUESDAY NIGHT: OCT 8, 2002:

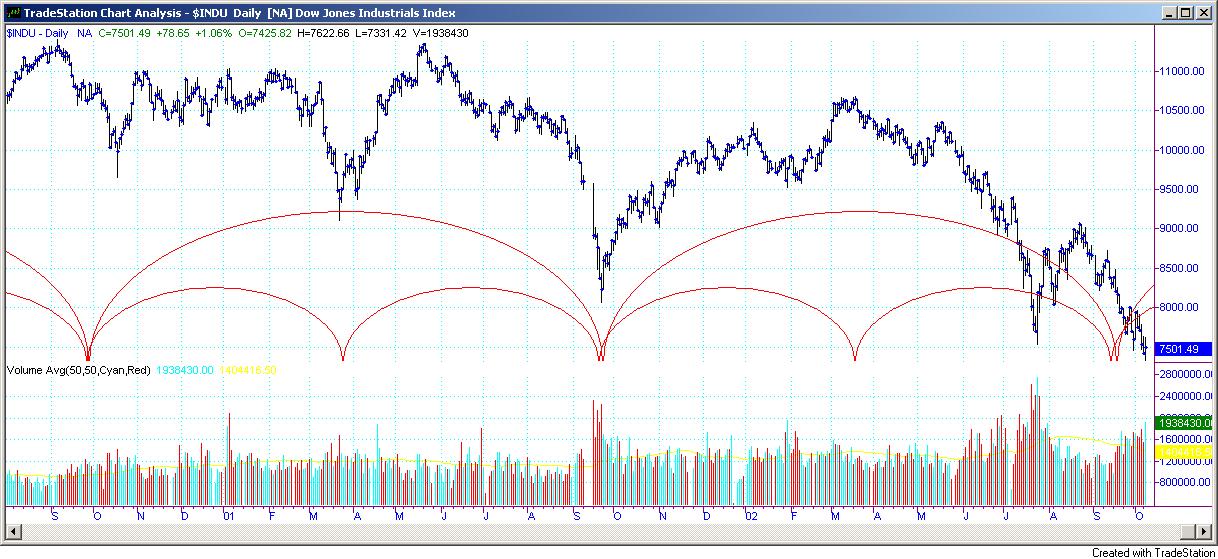

It still looks like we are hammering out a foundation a chunk at

a time, rather than plummeting into the abyss. The intraday Dow took us up

about 78 points, another reason to vote for this being a bottoming

formation. But, it went higher only after exploring new low territory down

to 7351. From the chart above you can see that we are only just past the

cycle lows, still experiencing some down draft from the double cycle

conjunction. Today's upward action confirms that the two cycles are now

exerting upward pressure, hopefully taking us into recovery areas, even if it's

only small.

Following the last double cycle low, we climbed just about 2,300

points over the ensuing 3 month time frame. We could climb 2,300 points

once again and still be in a serious downtrend. In fact, that point rise

from current levels would take us just to the bottom of the downsloping

trendline drawn off the peaks of the chart above.

Is this doom and gloom? No--take the profits and

run. It seems that this could be a great short term buying

opportunity. Even bear markets have corrective up waves as they

progress. We are, after all, traders, not investors.

QQQs

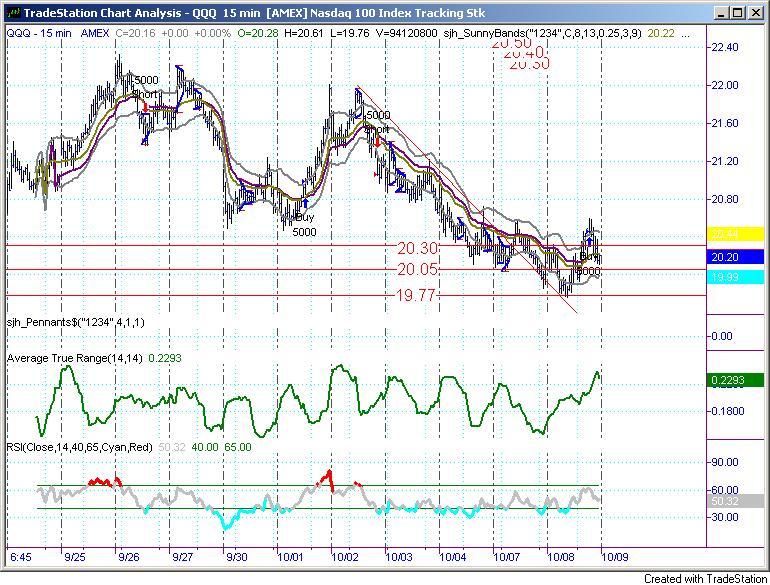

As the market was making new lows this morning, we gave an

alert to intraday Platinum Subscribers at 9:01amPT, saying that we had

just exceeded the lower SunnyBand and it was time to watch for profit

taking opportunities. That took us out of the QQQ short trade right

at the lows for the day! The alert to go long came at 11:52amPT,

and the market turned on a dime afterwards and went back downward.

But, it didn't hit our stop loss protection, so we are still long the

model overnight on the QQQs.

Our alert told subscribers to set the stop loss at 20.04,

which we may hit tomorrow on the open if we have a gap down. If so,

get out and stand aside watching for the market to poke its head back up

over the Attractor at 20.05 before re-entering. (Assuming we are

still on a buy signal at that time.) I'll let you know as it

transpires. Hopefully this is a new one-wave forming, and if so the

three wave should take us to 20.80 where we can take profits on this long

trade.

Price on the QQQ hit the upper SunnyBand, only to bounce

back down from it and head straight for the midline; but, it showed

strength by stopping near the midline. RSI has pulled back slightly

into neutral territory, which is nice because it gives it room to progress

into the 65 and above range tomorrow.

Stay tuned -- and stay nimble.

LESSON: SunnyBands are constructed around Sunny's Dynamic

Moving Average pair, by adding a multiple of ATRs to the faster moving

average. The Bands in the chart above are at 1 ATR, the theory being that

the market (whatever we are watching) will tend to move about at the same rate

it has been moving. If, on average, the Average True Range of a bar (be it

daily, weekly or 15-minute) is .2293 points, then we can expect the next bar to

have a similar ATR. If we move outside of this "normal" range,

then something out of the ordinary is happening, and we should watch for the

market to regress to the mean--that is to come back towards its average.

Thus, when price gets away from the midline (the sjhDMA) and touches the upper

SunnyBand, it is likely to (a) push hard and move quickly on upward or (b)

realize it has gone too far and turn around and come back. If case (a)

happens, then we often get very strong moves that continue for several

bars. In that case, we stay on our toes and watch for any turn back toward

the sjhDMA midline, which is when we would take profits. The SunnyBands

work great for setting stops and profit targets. This is a newly released

indicator, and if you are interested in having a license to use it on your own

TradeStation it is, like the others, $495.

|

|

How Did We Do?

Click here to view archives of past

Platinum Zone commentary, including the Weekend Stock Alerts.

Last week's stock alerts were hit on four stocks: FRE, MDT, MER & SPC.

We profited on three of the trades and hit the stop-loss on the fourth, for a

net profit of $260.

Click Here

to go to the Weekend Stock Alerts Archives to view prior weeks'

performance.

This week's (10/06/02) Sunny Side of the Street Weekend Stock Alerts:

|

Symbol |

BreakOut |

Run To |

Stop Loss |

Triggered? |

Goal Met? |

Net P/L |

1000 shares |

|

MMM |

115.56 |

119 |

112.84 |

|

|

|

|

|

GD |

86.62 |

91.07 |

82.89 |

|

|

|

|

|

UNH |

91.36 |

95.00 |

87.95 |

91.36 |

|

|

|

|

AZO |

81.27 |

83.00 |

79.00 |

|

|

|

|

|

CCU |

37.95 |

41.00 |

33.65 |

|

|

|

|

|

WLP |

78.30 |

83.28 |

72.00 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

The premium levels of membership to "The Sunny Side of the Street" get more

details, more commentary and more charts. The Gold and Platinum

levels get access to intraday analysis. If you are interested, give us a call at

(760) 930-1050. State your name over the answering device, and if

she's not in the middle of a trade Sunny will pick up and talk with you

personally. If she's not immediately available, Sunny will call you back

as soon as she can, so please leave your name and state your phone number

slowly. Thanks!

The passwords to the premium zones change every day, and you will

receive it by email with your notification that the commentary has been

posted. You must be a subscriber to view the Platinum and Pay-per-view

zones.

|