NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

"The Sunny Side of the Street"

Commentary

THURSDAY NIGHT--11/07/2002:

| symbol | close | upper Attractor | lower Attractor |

| INDU: | 8574.93 | 9000 | 8450 |

| QQQ: | 25.49 | 26.89 | 20.60 |

| SPz02: | 925.50 | 925.62 | 875 |

As the saying goes: "Buy the rumor, sell the news." Yesterday was anticipatory of a rate cut, today sold off on the fact of it actually happening.

It was another day of heading straight for an Attractor and then bouncing back and forth on the Attractor for the remainder of the day. Who's reading this? Is someone running my trades? This is the reason I'm only allowing a maximum of 1000 readers of the Sunny Side of the Street. We don't want too high of an exposure.

I covered my shorts this morning at 8:48amPT, and decided the market was due for a bounce, probably toward the Attractor at 26.00. Market only made it part way there before turning around and heading back down. Rather than get whipsawed again, I issued an alert warning to wait and watch, that I was going to go short overnight if we dropped even slightly below the current low for the day. The market did, and I went short. Within seconds a rapid drop occurred, followed by a bounce back up, and I'm left holding losing short positions overnight. Oh, well.

...Continued...

...Continued...

AND...a new and improved TradeStation EasyLanguage class to be held February 7-9, 2003, also in Carlsbad, CA. Why should you pay for this class when TradeStation teaches it for free?

I have been saying for months that we are digging a foundation, and that's what it still looks like we are doing.

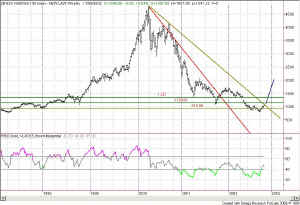

Taking a look at the weekly chart gives us yet another view of the Technical situation we are currently in.

The Blue Line that I have drawn at the right hand edge of the chart points directly to the current weekly closing, which has just now run up against a descending trendline that was formed by joining the top in March 2000 with the subsequent top in September 2000. Because of the Technical pressure from this trendline (which also then qualifies as an Attractor) we will have a hard time getting out beyond current price levels. However, when we do, it should be a sharp run up to 1139 on the $NDX.

RSI still has plenty of room to move on the weekly chart, whether it is going to stay neutral or get bullish, there is still room on the upside.

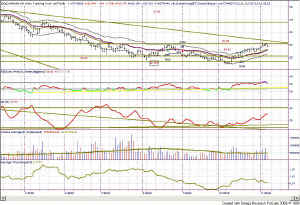

Back to the 15-minute chart for a bit, we are still in a sell signal, sitting right on top of the Attractor formed by the opening gap of 11/1. We have closed the gap. RSI is quite oversold on the 15-min chart, so that gives us room to move up, and ATR is quite low, calling for strong movement in either direction.

The SPoos chart looks a little different from the QQQs and the Dow, so let's visit it for just a minute. The SPz played with the Attractor zone the same as the Dow and the QQQs today, but what interests me is that it played with it from the underside toward the end of the day. That says to me that the SPz will exert downward pressure on the other two tomorrow morning, and that's where the profit from the short play is coming.

So, stay nimble! And, many happy returns.