NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

"The Sunny Side of the Street"

THURSDAY NIGHT--11/14/2002

|

Commentary:

It seems that more people are unable to receive the video than those who are able, so I will discontinue the broadcasts until more people are using cable or DSL lines. Back to the keyboard.

Last night I said I expected today (Thursday) to be an up day, maybe even sharply up. I also said I though the QQQs just might make the stretch to 26, and it did--closing today at 26.10.

On an intraday basis, I couldn't have been much more right on with last night's commentary. I said "sharply up" and it was sharply up! Furthermore, I called for 26, and we got 26.10.

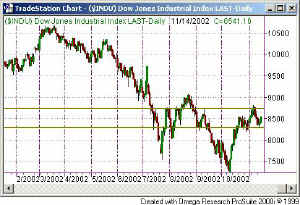

So, tomorrow the markets should make the attempt to break their upper Attractors, thereby bringing the QQQ on up with them. I would expect the QQQ to reach for 26.56 Friday, while the Dow reaches for 8724 and the S&P tries to reach 907.

After that little jaunt, we should see a correction--as the 3 wave we are currently in goes into a 4-wave corrective move. Since the 2-wave was sharply down, the 4-wave should scrape along sideways in some sort of triangular formation for several days. That should clear out most of the speculators, leaving only the professional traders to move the markets.

For tomorrow's traders, I expect the market to make a quick run up to the previously mentioned Attractors, and the fail to move higher, beginning the 4th wave decline.

Weekly Stock Picks for the week beginning 11/10/2002:

| symbol | breakout | stop loss | goal | triggered? |

profit/ loss |

| KRB | 21.66 | 20.56 | 25.00 | ||

| BMY | 27.21 | 24.50 | 31.00 | ||

| SLM | 104.35 | 103.00 | 107.00 | ||

| BMET | 32.00 | 30.00 | 34.00 | ||

| BMY | 28.00 | 26.00 | 33.25 | ||

| SBC | 28.86 | 26.15 | 34.40 | ||

| AET | 42.66 | 40.00 | 46.00 | ||

| BBBY | 35.11 | 31.00 | 40.00 | ||

| XLNX | 23.00 | 20.00 | 30.00 | ||

| XRX | 8.00 | 5.75 | 11.00 |

...Continued...

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.