NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

"The Sunny Side of the Street"

THURSDAY NIGHT--11/21/2002:

Figure 1 |

|

Those of you who don't know what my CPC Index™ is need to do one of two things: (1) read my book, "Trading 102--Getting Down to Business", or (2) take my seminar in January. Anyway, this is an astonishing result, because I usually say that you can't trade a system unless the CPC Index is greater than 1.2. And, 7.36 is well beyond 1.2!

So, just for fun, take a look at a chart of Corn, and see what you think.

INVESTORS

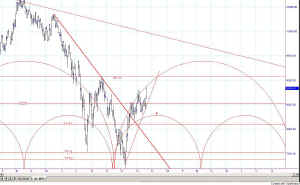

Looking at the long-term view, today's market action still did not get out beyond the long-term trendline you'll see on the Weekly chart below. That's of a little concern, it you are considering a long position, so beware. Once it crosses that trendline, it should shoot straight for the next trendline, which is currently lying at about 1139, where there is also an Attractor.

The overlapping cycles are still carrying the markets upward, at least for a few more days, until we get to the little red arrow I have drawn on the chart below. That would be the crest of the inner cycle and should exert some downward pressure--even at the same time the larger cycle is still moving upward. The result should be some sideways movement for a little while as the smaller cycle moves downward.

TRADERS

My model is long QQQ from 11/20 8:00am (see Figure 1 above). However, the 15-minute chart in Figure 1 above shows divergence on the RSI, and that is worrisome. Logically it would be about time for a little corrective action, as the market usually doesn't put in more than 3 days of strong upward movement in a row.

Today we just zoomed past the 26.89 resistance, which is usually how we get through resistance. I hardly ever see a meandering waltz through resistance. So, now 26.89 on the QQQs has been broken, and in the table at the top you will see a new Attractor for each index.

My Dynamic Average on the 15-minute chart is riding right on top of itself, and on any negative price movement will go into a sell signal tomorrow. Be nimble, and take profits when you see them. So far it looks like we have a sideways (time) corrective 4th wave in the making, which may or may not go down far enough to produce profits before the 5 wave comes in.

ALSO, notice below that some of the stock picks have been triggered. I exit on Friday if there's a profit, and pick new stocks on Sunday night. Sometimes the same ones qualify again, sometimes not.

Many happy returns! And, stay nimble.

Weekly Stock Picks for the week beginning 11/18/2002:

| symbol | breakout | stop loss | goal | close if triggered? |

profit/ loss |

| QCOM | 37.15 | 32.55 | 43.30 | 40.68 | $3,530 |

| PCAR | 46.26 | 44.69 | 48.00 | 48.98 | $2,720 |

| SNPS | 50.00 | 47.35 | 54.00 | 52.25 | $2,250 |

| ERTS | 67.00 | 68.50 | 66.30 | 67.50 | $500 |

| IBM | 81.00 | 79.00 | 83.50 | 84.90 | $3,900 |

| SANM | 3.45 | 3.19 | 3.75 | 3.481 | $31 |

| JDSU | 2.80 | 2.64 | 3.00 | 3.21 | $410 |

| RNWK | 3.80 | 3.61 | 4.00 | 4.08 | $280 |

| DISH | 19.45 | 19.00 | 20.28 | 19.48 | $30 |

| WEN | 28.18 | 27.67 | 28.74 | no | |

| TOTAL | $13,651 | ||||

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.