NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

"The Sunny Side of the Street"

MONDAY NIGHT--11/25/2002:

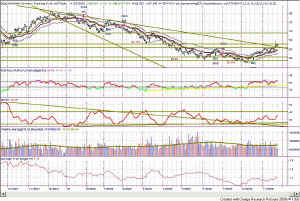

Figure 1 |

|

We have been long the daily model since 10/21 and continue to stay long as the market meanders its way on up to the next Attractor. The next level up is at 9076 and then at about 9500 on the Dow.

INVESTORS

The RSI has stayed nicely up in bullish territory for about 6 weeks, but I would like to see it move above 65 on the daily chart, and see some real powerful up days. Then I would believe this to be a rally rather than a correction.

On the QQQs we are up against the Attractor at 28.135 (we closed today at 28.030) and we will either blast through it tomorrow, or reflect downward off of it. I think the first scenario is more likely, as this 4th wave sideways is pretty much tilted upwards--which implies a strong 5th wave to follow.

I am going to be watching the continuing long trade with a stop at 27.40, just in case.

TRADERS

From a trading perspective today wasn't much fun. I exited my overnight long position early in the morning as I had a dental appointment this morning (obviously out of the office), and I don't like to leave trades unwatched.

Just as well, because when I came back the market was just playing see saw again. Don't get discouraged; that type of activity is impossible for anyone but floor traders to handle, and you'll see on the chart above that my system went short at the bottom of the move and long at the top of the move. What good is it? Well, if you just put one extra requirement on taking the trade after a signal it helps quite a bit. After any signal is given, I like to require that the market move in that direction. So, for instance if we get a short signal, the market must move lower than the price at which the signal was given. Using that rule, I did buy back in at the end of the day, and am sitting on a small loss overnight.

Lots of traders say "never take home a losing trade," meaning don't carry a loss overnight. But, in my experience, most of the movement on many, many days occurs on the gap, and then the day goes sideways from the open. I've been told I have ice water in my veins, and maybe it's true when it comes to trading. There is no place for emotion in this business.

As with the daily charts, the intraday RSI is bumping up against 65, and a downsloping trendline--so I would like to see it take off and get into the 80-90 range before we have a correction. I think there's room left above us for the 5th wave to stretch.

Many happy returns! And, stay nimble.

Weekly Stock Picks for the week beginning 11/24/2002:

| symbol | breakout | stop loss | goal | close if triggered? |

profit/ loss |

| WEN | 28.00 | 27.5 | 29.0 | ||

| KO | 46.50 | 44.25 | 50 | ||

| ACK | 1.90 | 1.28 | 2.67 | ||

| MCD | 19.33 | 18 | 22 | ||

| G | 31.50 | 30.50 | 33 | ||

| T | 28.11 | 27.74 | 28.6 | ||

| YHOO | 18.40 | 16.80 | 20.53 | ||

| COST | 33.07 | 31.57 | 34.57 | ||

| CIEN | 5.7 | 5.31 | 10 | ||

| JDSU | 3.3 | 3.02 | 5 | ||

| TOTAL | |||||

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.