NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

SUNDAY NIGHT--12/01/2002:

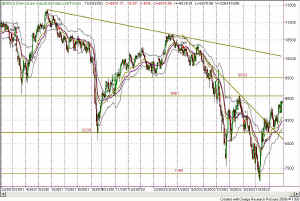

Figure 1 My model Weekend Stock Picks portfolio made $790 this past week with two winners and three losers. Click here to view the Archives. The daily Dow, Figure 1, has established a nice little up-trend, with only minor penetration of the line on a few occasions. See Figure 2 for a close-up look at the trendline as I have drawn it. |

|

||||||||||||||||

Figure 2 |

The Dow now has three attempts at rising above 8931 with no success. So we now have a Triple Top, or perhaps an Ascending Triangle. Bulkowski calls these "Bump and Run Reversals." His statistics say that 82% of the time a BARR will qualify as a reversal. |

Given that information, and my premise that holidays are reversed on the next "normal" trading day, Monday Dec 2 should be a down day. However, we have another significant holiday overlaying the market movement all next week: Hanukkah. Over the years I have watched this holiday lower the volume and participation in the markets, producing choppy markets until after the holidays.

If we ignore the holiday effect and just read the technicals of the charts, the Dow, SPoos and QQQs all have Attractors looming overhead that are nearly irresistible. The Attractor on the QQQs is echoing the September 2001 lows and their re-test on 5/7/2002. (And again several times in June). The QQQs need to blast through this line, which lies at 28.42, or we will most likely be in for a correction down to the lower Attractor at 26.00. The correction seems like the most likely scenario for the QQQs over the next 10 days or so. (See Figure 3)

The story reads a little differently on the SPX, however. The downsloping trendline was broken decisively without a retest. That's very positive. It would appear that we are in a three-wave of fairly long duration. And, with the Attractor sitting at 961, we can assume that the 3-wave is not yet complete. The 3-wave cannot be the shortest wave in the formation, or it's not a 3-wave, so we can figure that this move must break through 961, or the wave count is incorrect. The daily Average True Range has been steadily diminishing since October 17, and is near its typical low. To me that says we are in for a big move. What is doesn't say is which direction.

For more information on direction, we need to step back to the weekly and monthly charts. In Figure 4 you can see that the SPX has successfully tested and bounced off of the Attractor at 810. Not only that, but the complex Head-and-Shoulders pattern is still in the process of forming. The neckline for this pattern is at about 974, and it looks to me like the SPX will make a run for 974 and then either blast through, or reflect off. That gives me another 30 points upward on the SPX.

On the Dow weekly chart, price is above the 20 week moving average, and above my Dynamic Moving Average. It is also above the Attractor at 8450. (Figure 5)

And, price on the Dow is also above the neckline on the complex H&S pattern.

The next Attractor is overhead at about 9500. It looks to me like that's where we are headed. RSI on the weekly chart has formed a positive divergence, and is currently at about 50 and heading upward. The same is true of RSI on the Dow, positive divergence and a value of 53.

In summary, for traders and investors, be careful. The chart reading indicates that there is room for the NASDAQ to go down and the S&P and Dow to go up. That typically generates confusion and choppy sideways activity.

Many happy returns! And, stay nimble.

Weekly Stock Picks for the week beginning 12/01/2002:

(Last week's picks made a profit of $790. Click Here to view the picks for last week, in the Archives.)

| symbol | breakout | stop loss | goal | close if triggered? |

profit/ loss |

| NSOL | 0.9 | 0.5 | 1.5 | ||

| COMS | 5.3 | 5.0 | 6.25 | ||

| CMGI | at market | 1.0 | 3.0 | ||

| ADCT | 2.57 | 1.5 | 4.5 | ||

| MCLD | 0.93 | 0.80 | 1.4 | ||

| AMGN | 48.7 | 43.46 | 54 | ||

| ALTR | 15.25 | 13.0 | 20.0 | ||

| ADPT | 7.44 | 5.16 | 10.00 | ||

| AAPL | 16.43 | 15.00 | 18.25 | ||

| ADBE | 30.4 | 28.9 | 33.23 | ||

| TOTAL | |||||

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.