NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

THURSDAY NIGHT--12/05/2002:

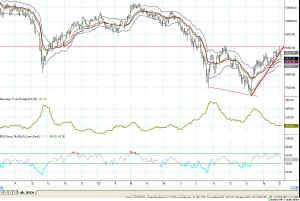

Now for the Technical Analysis of today and tomorrow. In Figure 1, at the top, you can see that today's low nearly touched the middle Sunny_Bands. Those lines at the middle are the two Sunny_DMA lines (Dynamic Moving Average). As they act as Attractors, pulling prices toward the mean, you will also notice that the upsloping trendline I have drawn in red has been violated both today and yesterday. These are signs of negative intention.

Compounding the negative foreboding is the RSI, which just barely touched 65 three times, but never went over it into bullish territory. I wanted to see stronger action than that if we are forming a bullish move.

In order to read this more accurately, let's take a look at the same time-frame (daily), but over a longer time-span (back to August 2001).

Figure 3 - INDU Daily back to August 2001

On the chart in Figure 3 I have drawn an horizontal line over the current top, and the top preceding it. Notice that the line also acts as an Attractor (support and resistance) in August, and July of 2002 and November 2001. That makes it look like pretty strong overhead resistance. And, so far, we are unable to penetrate it. You can also see that with the trendline I have drawn off the bottoms we have a broadening formation. Bulkowski says that while most of the literature considers this bearish, that his research showed it to be bullish, breaking to the upside 57% of the time.

The S&P, Dow and QQQs all three show the same overhead Attractors holding the market down, and the same broadening patterns which most people consider to be bearish. The weekly charts show the Head-and-Shoulders patterns on all three. Thus, as a traditional Technical Analyst I would think that the market is headed much farther down. But, somehow I don't feel that way. My instinct tells me that the market will, in the next few weeks, pop right out of those formations and head upward. When it does, I think we will play the 9000 - 10500 range for a long time to come, creating a broad, long-term channel. I'm not voting for a reversal of the bear market to begin another straight up bull market, but rather a long-term sideways market (I call those Chicken Markets.)

As for tomorrow, I'm flat coming into the day, but I should be short. Depending on what happens at the open, I will either stay flat, or take a position. I'll send out emails in the morning as to that.

Do your situps and pushups, leg lifts and knee bends--and stay nimble.

Weekly Stock Picks for the week beginning 12/01/2002:

(Last week's picks made a profit of $790. Click Here to view the picks for last week, in the Archives.)

| symbol | breakout | stop loss | goal | closing price if triggered? |

profit/ loss |

| NSOL | 0.9 | 0.5 | 1.5 | ||

| COMS | 5.3 | 5.0 | 6.25 | ||

| CMGI | at market | 1.0 | 3.0 | yes | |

| ADCT | 2.57 | 1.5 | 4.5 | ||

| MCLD | 0.93 | 0.80 | 1.4 | yes | |

| AMGN | 48.7 | 43.46 | 54 | ||

| ALTR | 15.25 | 13.0 | 20.0 | ||

| ADPT | 7.44 | 5.16 | 10.00 | ||

| AAPL | 16.43 | 15.00 | 18.25 | ||

| ADBE | 30.4 | 28.9 | 33.23 | ||

| TOTAL | |||||

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students.