NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

MONDAY NIGHT--12/10/2002:

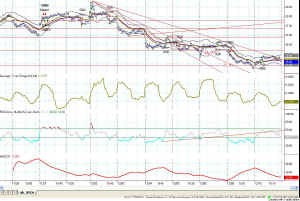

Looking at the chart of the Dow in Figure 1 above, you can also see that RSI still didn't make it above the 65 mark, and that says to me that the market is still being pulled down by the Attractors underneath. For instance, the Dow is being pulled down by the Attractor at 8450. The Dow's up move today was halted by the midline on the Sunny_Bands and we really didn't make any progress in either direction.

I am still expecting the corrective action to occur, to take the Dow on down to 8450, the QQQs to 20.60 and the SPoos to 875. At the very least each of the markets should go down to touch the bottom Sunny_Band, which you can see on the enlargement of Figure 1 and 2.

In Figure 2 you can see the trendlines that I was using to trade today's market. Of the three downsloping lines that form a fan, the top most trendline stopped further upward movement this afternoon. In fact, the market turned back right where the trendline and the Sunny_Bands conjunct.

Average True Range is still contracting, as we move along sideways and build up the pressure for another spurt of directional movement.

Notice also, on the enlargement of Figure 2, the trendline I have drawn on RSI. It was drawn from the bottoms on 12/04 and 12/05 with "extend to the right" turned on. It is interesting, to me at least, that RSI's upward movement was curtailed by this trendline, keeping it from rising into the 65 and beyond range.

I think what is most likely next is still for the markets to correct down to the lower bands, and then take another surprise bounce upward.

Be quick, be nimble, and always keep your respect for the markets--it's a risky business.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! Enroll

Now--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! Enroll

Now--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 12/08/2002:

(Last week's picks made a profit of $0. Click Here to view the picks for last week, in the Archives.)

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| AEP | 30 | 26 | 35 | ||

| APC | 50 | 44.5 | 57 | ||

| BK | 30 | 27.1 | 35.26 | ||

| GM | 40 | 47 | 37 | ||

| NKE | 48 | 45 | 52 | ||

| MDT | 47.29 | 43.62 | 51.65 | ||

| TOTAL |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.