NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

MONDAY NIGHT--12/16/2002:

Why is it so difficult to follow a system? Even after my commentary of last night, wherein I said I thought the Dow & SP would bounce, and even after my own system gave a buy signal, I still held stubbornly to my short trade from the trading day previous. It had a nice profit in it on the close of Friday and I got greedy. I wanted more profit. And, somehow I thought that the market was going to fake us out on the opening gap and come back down. Wishful thinking got me into trouble. If I have said it once to an audience, I have said it over a thousand times: "Follow the System!"

I spent 3 years, working 18 hours days, day in and day out, to design and test this model that I use--and then I chose today to try and out-guess it.

Oh well. Chalk it up to more experience.

I tell you, my subscribers, this because I want you to know that following a system with discipline is one of the very most difficult things one can do in trading the markets. Most people do what I did today, more often than they are able to follow the rules. It seems to be human nature to try to make things better and to think you can have some sort of intuitive input that will out-smart a mechanical system.

After you have taken my 3-day "Solving the Puzzle" class, you will completely understand why you must follow the system, and you will know how to design and test systems. Only after testing your own system, or the system you want to follow, will you be completely comfortable following its signals. And, even then there are days like my day today.

So, when it happens to you, pick yourself up, brush yourself off, and start all over again the next morning. You can't think about yesterday's trades. Each day, and each trade is a new experience unto its own.

BRING A FRIEND AND GET 1 MONTH FOR FREE. For each person you refer to The Sunny Side of the Street (and who subscribes) I will give you a free month on your personal subscription. This is a word of mouth business, and I need your help to spread the word. If you tell a friend, just email me his name/email address, and if he/she subscribes you will get the credit, and a warm welcome thanks from me.

Traders, my intraday model is long the DIA, long the QQQs, long the SPY, all from this morning.

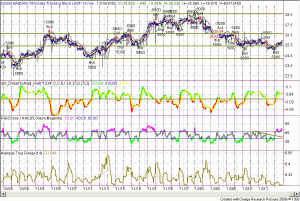

You can see in Figure 2 that we have just barely broken the resistance that was at 91.58 on the SPY. The next resistance up from there is at 92.01, so it's possible that 92.01 is as far as the follow through may go tomorrow. But, as I said in the commentary of the 15th, this is window-dressing time and the markets can get wild.

You can see in Figure 3 that the same thing is true--we are pressed right up against resistance in this figure. In fact, it might act to hold down tomorrow's progress.

On the QQQs, the story is just a little different, with today's action decisively breaking through resistance and moving up toward a free-flowing area, where the next resistance is up at 26.62. That, in itself, could be enough to carry the other markets on upward tomorrow.

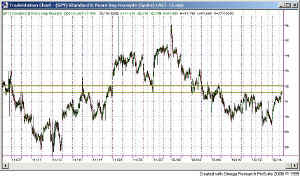

Investors, we finally have a bar on the Dow that is almost outside of the range of the engulfing bar from 5 days ago. A little more push upward tomorrow and we will be over the line. If we make it over the resistance line tomorrow, then it's next stop should be 9061. (See Figure 1) On the side of caution, I want you to look at the RSI in Figure 1. Notice that the trendline I drew on over the tops of the RSI over 2 weeks ago has now been pushed on and is acting as resistance. That could possibly cause the market to stumble tomorrow, before moving further up. We still haven't shown the bullishness I like to see with the RSI at and over 65, so we are not out of the murky waters yet.

As always, be cautious, be nimble, and good luck!

I'LL MAKE YOU ANOTHER OFFER. Send a friend my way for one of the upcoming seminars, and I'll give you $250 cash. Take your loved on to a nice dinner out on me.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 12/15/2002:

(Last week's picks made a profit of $0. Click Here to view the picks for last week, in the Archives.)

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| NSOL | 0.78 | 0.62 | 1 | ||

| AMCC | 4.11 | 3.63 | 5.28 | ||

| ADCT | 2.24 | 1.64 | 2.81 | ||

| ADBE | 27.18 | 24.73 | 32 | ||

| WIN | 15.3 | 14.02 | 18 | ||

| WPI | 30.12 | 28.15 | 33.5 | ||

| STI | 60.25 | 56.63 | 68 | ||

| SLE | 22.77 | 21.56 | 24 | ||

| RBK | 28.38 | 27.04 | 30 | ||

| FO | 50 | 47.36 | 54 | ||

| TOTAL |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.