NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

SUNDAY NIGHT--12/29/2002

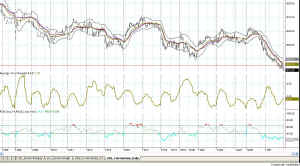

Figure 2 - S&P Composite Daily

The only strategies that seem to have been working lately are breakout systems. You look for congestion and then follow the direction of the breakout. That's the strategy I employ for trading stocks, but I only take long positions in stocks. Trading the indexes (whether DIA, SPY or QQQ) over the long historical past has worked well using moving averages. Currently, however, even these seem to be working best with breakout strategies, because the turns have been so sharp and so fast.

If we now take a look at the daily QQQ chart in Figure 3, you can see that price is approaching the 24.30 Attractor once again.

In the months since I have began writing this commentary, the QQQ has touched the 24.30 Attractor 11 times. It must be a pretty important number. Because of that, I think it will touch that barrier once again.

The current bear market will be three years old in March, if it continues. I find it hopeful that the range (that is the High minus the Low of a bar) continues to get smaller and smaller as time goes on. If the QQQs can hold 24.30 and bounce upward from there, we might just have the beginning of a new baby bull market.

INVESTORS:

I am still short the daily QQQ model from 12/20/2002. And, in fact at this juncture the short-term and the long-term models are coinciding, with the 15-minute model also being short. When they agree like this is often a good time to place some risk capital on doubling the bet. If I decide tomorrow to do this, I won't hold that double-size bet for very long.

TRADERS:

I am still short the QQQs and expect to be very nimble on Monday looking for a potential bounce on the 24.30 Attractor. If it looks like it's going to bounce, I'll be taking profits. If it drops through the Attractor then I will

be watching even more closely for a quick drop followed by a bounce. Remember, we are still in holiday mode and the unpredictable will happen.

So, as always, stay nimble, humble and take small losses and big wins.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 12/15/2002:

(Last week's picks made a profit of $670. Click Here to view the picks for last week, in the Archives.)

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TOTAL |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.