NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

WEDNESDAY NIGHT--January 8, 2003

My guess is that the Dow has to go up to hit the magenta trendline, or enough time must pass with the Dow going sideways for the two to meet. After that happens, then we will have come to the downward phase of both cycles in tandem. That's when the markets, namely the QQQ here, will begin another downdraft and scare out the remaining "weak hands." I think, however, that in the upcoming downdraft that the downside will not be as low as the low in October. I am expecting the next low to stop at about 8027 basis the Dow.

Today's drop took the Dow only back to the Attractor and the 50 day moving average, so it was an anticipated and normal sort of drop. Nothing that should be worrisome as yet.

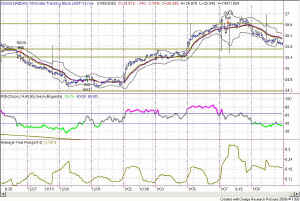

Intraday I sent out two alerts that I was going short. Good calls as today was virtually a short day. See Figure 2.

RSI weakened today, dropping off of the 60 line and moving lower into the bearish center of the channel. To me that says that tomorrow should be a little further down than today, probably dropping into the 25.7 to 25.4 range. After that we should take a bounce upward toward the 27.5 area. My intraday model is short since 1/7/03 at 8:45amPT, while the long-term daily model is also short the QQQs, with resistance overhead at 26.671--against which price is currently pressing.

Like the intraday RSI, the daily RSI weakened today, reentering the bearish range, with Average True Range getting extremely low.

So, there are two things in conflict. Prices are pushing up against overhead resistance on the daily charts and are being pulled down by the overlapping cycles at the same time. That's a difficult situation, which could just as easily resolve one way as the other.

LONG RANGE I am still short, or neutral, watching only for stocks that breakout of my weekend picks.

INTRADAY I will play it with my Dynamic Moving Average on the 15 minute charts and ...

... as always, stay nimble, humble and take small losses and big wins.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt | 17.49 | 19.11 | ||

| WPI | 29.5 | 27.44 | 33 | ||

| AHLS | 0.83 | 0.50 | 1.4 | ||

| ASDS | 0.46 | 0.37 | 0.6 | ||

| CNXT | 1.85 | 1.5 | 2.5 | ||

| JDSU | 2.95 | 2.38 | 3.5 | ||

| LGTO | 5.52 | 4.33 | 7.63 | ||

| MCHP | 26 | 24 | 30 | ||

| PCAR | 48.3 | 46.3 | 51.6 | ||

| RNWK | 4.06 | 3.5 | 5 | ||

| TOTAL |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.