NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

THURSDAY NIGHT--January 9, 2003

66 cents, which is less than the current Average True Range. The intraday prices on the QQQ are attempting to make it over the hurdle of 26.671 and peaking through, but the candle bodies are closing ho higher than the hurdle. See Figure 2. I think that the longer it takes to get through the hurdle, the less likely it is that the QQQs will make a sustained run upward.

Figure 2 - QQQ Daily (enlarged)

My daily model is still in a sell signal, even with prices higher than at the occurrence of the signal. So, as a true system follower, my long-term holdings in the QQQs should be short. In actuality, I am standing on the sidelines at the moment since the prices are in the upper half of the Sunny_Bands. I don't want to be short while price is pushing upward on the Sunny_Bands.

RSI is still playing the weak sister, not even making it up to the 60 zone, while prices are trying to push upward, so that doesn't give me any encouragement to be long either.

The Dow is now firmly above its 50-day moving average, with 4 days of activity above the line. However, it has not yet met the Attractor at 9061, which would put it at the 200-day moving average as well.

I still think we will see this upside activity, because the markets are trying to budge on up, but are meeting with heavy resistance in the effort.

There are soothsayers out there (not mentioning any names) who are calling for the collapse of the dollar and the US economy following along Japan's example of a 12-year recession (read depression). But, I just don't think that's what we are seeing here. While I don't think we are in for much lower prices, however, I do think we need to be cautious as prices meander along sideways, going no where for possibly a long period of time.

Trading is difficult because the ATR on most indexes is so low that by the time you get long, the market turns around and goes the other way. This choppiness has been going on for a long time, and I expect it to continue as the markets build a bottom. More than any other time, this resembles the 60s when the Dow couldn't break 1000 for so long.

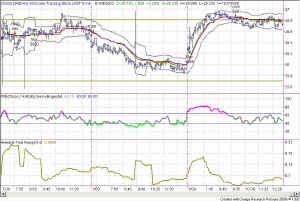

Just out of curiosity, I'm taking a look at the 5-minute QQQ chart, and I see that it went into a buy position this morning and a sell position on the model this afternoon. Seems like that would have been the best positions to have taken.

In Figure 3 you can clearly see how the prices went above the Attractor line and then back down through to end the day underneath the Attractor. This chart makes it look like the next day will bring downside action into the 25.70 QQQ range as we chop along for yet another day.

... as always, stay nimble, humble and take small losses and big wins.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt | 17.49 | 19.11 | ||

| WPI | 29.5 | 27.44 | 33 | ||

| AHLS | 0.83 | 0.50 | 1.4 | ||

| ASDS | 0.46 | 0.37 | 0.6 | ||

| CNXT | 1.85 | 1.5 | 2.5 | ||

| JDSU | 2.95 | 2.38 | 3.5 | ||

| LGTO | 5.52 | 4.33 | 7.63 | ||

| MCHP | 26 | 24 | 30 | ||

| PCAR | 48.3 | 46.3 | 51.6 | ||

| RNWK | 4.06 | 3.5 | 5 | ||

| TOTAL |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.