NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

MONDAY NIGHT--January 13, 2003

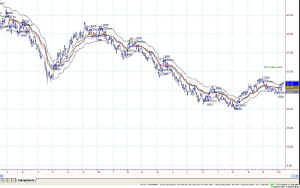

Figure 2 - QQQ 15-minute chart expanded

You can see in Figure 2 that almost immediately after my Alert went out that the QQQs began a precipitous drop, and subsequently bounced back into the trader's nightmare--whipsaw for the rest of the day. You can see from the indicator I have on the chart that following that system today would have had you long, then short, then long and then short again--all losing trades. This isn't the system I'm following, but it is one I am testing for a client. It is a nice illustration of what happens to a non-dynamic moving average in a dynamic yet sideways market.

By now you know that the gray bands above and below price are the Sunny_Bands and that the middle lines (gold and purple) are my Dynamic Moving Average (DMA). You can see that we were just channel trading today, on both sides of the DMA.

This sort of activity is still the aftermath, or perhaps foremath, of continuing to bump up against resistance and not being able to break through. Same old stuff we've been doing for weeks.

Hold onto your hats fellas, I think it's about to explode.

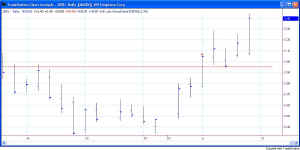

Figure 3 gives me a longer perspective, showing that the price action on the QQQs has diminished down to a dull grind. Price has been going nowhere, in a very narrow (historically) range since July 2002. Everytime it hits the Attractor at about 27.40 it falls back, but not really very far. The fact that it hasn't collapsed in all that time is what I think is encouraging. To me it keeps looking like the ant farm I bought my grandsons for Christmas. Slow progress building a base, but every day they make progress.

RSI is still hovering around the middle of the range, but it is pointing upward. RSI is building up steam as it slowly works its way upward without making new lows. Of course there is no way to tell what's in store for the future, but some precipitating event is coming soon, because the markets can't just slow to a dead halt. The news hounds will then blame (or give credit) to the "fundamental" event that "caused" the market to move--but it will really just be a technical burst away from the congestion it has been in.

INVESTORS: I am still on the sidelines basis the QQQs, waiting for price to break above that magical, magnetic 27.40 line. That's where I'll go long.

TRADERS: As you know, I exited my long position to take profits today, and saw no compelling reason to get back into the long position.

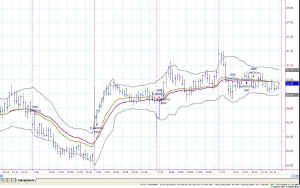

Figure 4 - 15-minute QQQs with Sunny's Dynamic Average

In contrast to the indicator in Figure 2, my DMA didn't get whipsawed today, as it usually does a pretty good job of sidestepping the congested areas. Unless there is a compelling reason to make a move, just stay where you are. So, tomorrow morning, if we break above 27.40 I will go long. If we dip below 26.80 I will go in for a quick short.

I sent each of you an invitation to join Microsoft Instant Messenger so that I can IM the SSS Alerts to you for instantaneous notification. Also, if we IM you won't need to check your email constantly--you will get a beep that tells you you have a message. If enough of you respond positively to the invitation, and signup and also sign on, I'll take our communication to the next level of modernization.

On Friday, Saturday and Sunday of this week I will be teaching one of my "Solving the Puzzle" seminars. On Friday I will be trading live before the class, so I don't know whether I will be able to send out email alerts. I wish each of you could come to the seminar to be spoon-fed the information and insights I have spent the last 22 years acquiring. It's a fun and jam-packed weekend of intense learning. Anyway, don't be surprised if I am incommunicado on Friday.

And, ... as always, stay nimble, humble and take small losses and big wins.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 1/13/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TXN | 17.50 | 16.00 | 20.00 | ||

| ADBE | 28.70 | 27.00 | 30.00 | ||

| AMGN | 50.60 | 48.70 | 53.00 | ||

| APCC | 15.65 | 15.00 | 16.75 | ||

| CNXT | 1.76 | 1.60 | 1.90 | ||

| DISH | 26.45 | 25.00 | 29.50 | ||

| INTC | 17.55 | 16.50 | 19.00 | ||

| INTU | 51.00 | 48.25 | 52.50 | ||

| MCHP | 28.00 | 26.24 | 30.00 | ||

| QCOM | 39.00 | 35.00 | 44.00 | ||

| TOTAL |

ARCHIVE:

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt=18.25 | 17.49 | 19.11 | 19.02 | $770 |

| WPI | 29.50 | 27.44 | 33 | no | |

| AHLS | 0.83 | 0.50 | 1.4 | no | |

| ASDS | 0.46 | 0.37 | 0.6 | no | |

| CNXT | 1.85 | 1.5 | 2.5 | no | |

| JDSU | 2.95 | 2.38 | 3.5 | 3.40 | $450 |

| LGTO | 5.52 | 4.33 | 7.63 | 5.87 | $350 |

| MCHP | 26 | 24 | 30 | no | |

| PCAR | 48.3 | 46.3 | 51.6 | no | |

| RNWK | 4.06 | 3.5 | 5 | no | |

| TOTAL | $1,570 |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.