NAVIGATION:

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

WEDNESDAY NIGHT--January 15, 2003

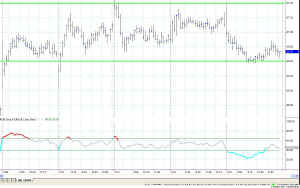

So, today is Wednesday and we get a small breakout, to

the downside. The QQQs have been going sideways for essentially 5

days, traveling in a narrow channel with RSI creeping along, dipping a

little more and then a

Figure 2 - QQQ 15-minute chart

little more to the downside. Today's market action took the QQQs RSI all the way down into bear territory, with the RSI low being at 26.6, well below our 40 mark.

I got short this morning at 7:30 amPT on the signal from my model, and then took profits when price hit the Attractor at 26.60. I thought it might bounce off the Attractor, and it did. The QQQs climbed then until reaching resistance at 26.83, where there was a previous high on 1/7/2003. At that level the QQQs turned back downward, reflecting off the Attractor.

The 15-minute Average True Range is now as low as 10cents on the QQQs. That's nearly dead. On the daily chart of the QQQs the ATR is down to 81cents--again, dead.

Four or five years ago I was asked, as a speaker at some conference, what I thought would happen to the market if it became all electronic. I said then that one option would be for the markets to become truly efficient and become flat as computers traded against each other. Without the elements of human fear and greed it is quite possible that the markets could equalize and become a flat line. Is that what's happening now? I don't know, but trading sure isn't what it used to be. It is very difficult to make any money in a market that moves 10cents, or 81cents for that matter.

The S&P opened higher and closed lower, producing one of those odd bearish candlesticks that is higher than yesterday's candlestick. I've noticed that after those filled candlesticks that are rising, the market tends to trade even higher the following day.

At least the S&P was a tradable entity today, dropping nearly 10 points from the open. Trading one contract at $250 could have netted $2500--and that's worth trading for.

INVESTORS

My model is long the Dow (INDU) since 10/21/2002. It also looks like it is retrying an attempt at 9000, but in a "climbing the wall of worry" fashion. 9000 is the magical point where we either burst through, or reflect off. If we reflect off and go down again, it will likely be back to the 8000 level as fear sets in.

TRADERS

Price on the QQQ is going sideways while the RSI is moving lower and lower. This could be a divergence. It leads me to expect impending up movement, as we have been dead in the water too long. My Dynamic Average Histogram is just about to touch zero. Will it bounce off and upward like it did the first week of the year? Or will it cross zero and drop the market down with it? Be ready for either, with the reflexes to react either way it goes. But for now, I'm waiting for some sort of movement in one direction or the other to tell me which way the market wants to go.

And, ... as always, stay nimble, humble and take small losses and big wins.

![]() Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few trading seminars each

year. She calls them "Solving the Puzzle"

because she

puts all the pieces together into one cohesive plan for you to become a

better trader. Make it your business! View

the syllabus--she only takes 15 students. January 17-19, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 1/13/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TXN | 17.50 | 16.00 | 20.00 | ||

| ADBE | 28.70 | 27.00 | 30.00 | ||

| AMGN | 50.60 | 48.70 | 53.00 | ||

| APCC | 15.65 | 15.00 | 16.75 | ||

| CNXT | 1.76 | 1.60 | 1.90 | ||

| DISH | 26.45 | 25.00 | 29.50 | ||

| INTC | 17.55 | 16.50 | 19.00 | ||

| INTU | 51.00 | 48.25 | 52.50 | ||

| MCHP | 28.00 | 26.24 | 30.00 | ||

| QCOM | 39.00 | 35.00 | 44.00 | ||

| TOTAL |

ARCHIVE:

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt=18.25 | 17.49 | 19.11 | 19.02 | $770 |

| WPI | 29.50 | 27.44 | 33 | no | |

| AHLS | 0.83 | 0.50 | 1.4 | no | |

| ASDS | 0.46 | 0.37 | 0.6 | no | |

| CNXT | 1.85 | 1.5 | 2.5 | no | |

| JDSU | 2.95 | 2.38 | 3.5 | 3.40 | $450 |

| LGTO | 5.52 | 4.33 | 7.63 | 5.87 | $350 |

| MCHP | 26 | 24 | 30 | no | |

| PCAR | 48.3 | 46.3 | 51.6 | no | |

| RNWK | 4.06 | 3.5 | 5 | no | |

| TOTAL | $1,570 |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.