NAVIGATION:

| SSS Bulletin Board |

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

TUESDAY NIGHT--January 28, 2003

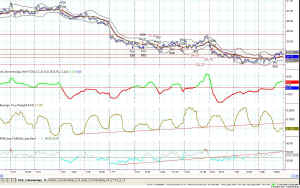

Figure 1 - Daily chart of INDU w/ Cycles Gold climbed higher again today, with the stock market climbing as well. Nothing wrong with that, the world is wary of war. The Dow held nicely above its current Attractor, bouncing upward right off the mark. That helped me breathe a little easier, as I really don't want to see the markets get much lower. But, aside from that emotional side of the picture, on my model I had a sell signal coming into the morning, from 1/24 7:15--which I have been scaling in and out of quickly over the past few days. And, this morning the model gave a solid buy signal [more...] |

|

||||||||||||||||||||||||||||

[...more]

I say "solid" because prices finally passed through some of the sideways grinding that has been going on the past 7 days. When the alert was given this morning I said "it looks good" meaning that I expected some movement out of it, because price had penetrated an important overhead resistance area.

At the close, however, prices on the QQQ dipped back down and touched the middle Sunny_Bands line, which might have led some of you to exit the long trade. I issued a warning to set a tight stop, not knowing what the overnight might bring. I also issued an alert saying that I might take profits if price touched the upper Attractor (at 25.11 on charts from yesterday), but it didn't get that high.

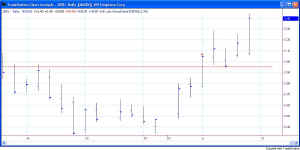

The chart in Figure 2 shows the steady climb of the Average True Range as it oscillates up and down on a 15-minute chart. Remember that the peak True Range of the day is not where the ATR peaks, because of the lagging factor of the Averaging process. Also on this chart you will see that there is another higher Attractor at 25.81, and this is where I think we are headed for the moment. It will take a decisive breakout tomorrow of the 25.11 line in order to achieve it, but that's the channel target I am watching for.

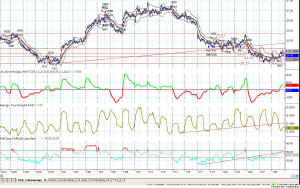

If you observe the same 15-minute chart of the QQQs on a longer term basis (in Figure 3) you can see a probable Head-and-Shoulders formation in action, with an upsloping trendline drawn across the bottoms of the dips forming the neckline.

Figure 3 - QQQ 15-min Longer Term showing possible H&S

This chart gives evidence that makes me think QQQ price will head higher (at least briefly) for the 25.81 Attractor, as the neckline trendline extends higher, right into that same area. It would make sense for price to at least make an attempt to test the neckline before deciding whether to go on upward or to fail and fall on downward after the failed test.

The morning's open on the 29th will be interesting. I don't know whether to think we will gap up and go sideways, or gap down and recover upward. The market is so skittish these days that it is next to impossible to trade.

So, as always, stay nimble, humble and take small losses and big wins.

PS - Don't forget about the new Bulletin Board. There's a question in there which I will answer tonight, and I appreciate it, from whomever the subscriber was. Until I insert a field for your name, please sign your inquiries as it helps me to relate to whom I'm teaching and at what level.

Thanks for participating.

![]() Don't miss

it--Sunny only gives a few Trading with TradeStation and Using

EasyLanguage seminars each

year. She calls them "TradeStation

Made Easy"

because she pulls all the important parts of trading

together with all the important parts of TradeStation to make one

cohesive, easy to understand Workshop. Make it your business! View

the syllabus--she only takes 15 students. February 7-9, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Don't miss

it--Sunny only gives a few Trading with TradeStation and Using

EasyLanguage seminars each

year. She calls them "TradeStation

Made Easy"

because she pulls all the important parts of trading

together with all the important parts of TradeStation to make one

cohesive, easy to understand Workshop. Make it your business! View

the syllabus--she only takes 15 students. February 7-9, 2003.

AND..to match Larry Williams' offer, on Friday we will be trading real-time,

with real money. I will split the winnings with the

class, and if there are losses I'll keep them for myself. Just

think...the seminar could be free!

Weekly Stock Picks for the week beginning 1/13/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TXN | 17.50 | 16.00 | 20.00 | ||

| ADBE | 28.70 | 27.00 | 30.00 | ||

| AMGN | 50.60 | 48.70 | 53.00 | ||

| APCC | 15.65 | 15.00 | 16.75 | ||

| CNXT | 1.76 | 1.60 | 1.90 | ||

| DISH | 26.45 | 25.00 | 29.50 | ||

| INTC | 17.55 | 16.50 | 19.00 | ||

| INTU | 51.00 | 48.25 | 52.50 | ||

| MCHP | 28.00 | 26.24 | 30.00 | ||

| QCOM | 39.00 | 35.00 | 44.00 | ||

| TOTAL |

ARCHIVE:

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt=18.25 | 17.49 | 19.11 | 19.02 | $770 |

| WPI | 29.50 | 27.44 | 33 | no | |

| AHLS | 0.83 | 0.50 | 1.4 | no | |

| ASDS | 0.46 | 0.37 | 0.6 | no | |

| CNXT | 1.85 | 1.5 | 2.5 | no | |

| JDSU | 2.95 | 2.38 | 3.5 | 3.40 | $450 |

| LGTO | 5.52 | 4.33 | 7.63 | 5.87 | $350 |

| MCHP | 26 | 24 | 30 | no | |

| PCAR | 48.3 | 46.3 | 51.6 | no | |

| RNWK | 4.06 | 3.5 | 5 | no | |

| TOTAL | $1,570 |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.