NAVIGATION:

| SSS Bulletin Board |

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

WEDNESDAY NIGHT--January 29, 2003

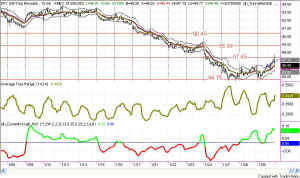

Figure 1 - Daily chart of QQQ w/ Range Gold's a little up, stock's a little down. This correlation is a little more true to the average see-saw nature of markets. I have now previewed the upcoming version of TradeStation 7 and I must say, I am impressed. It's magnificent. I don't know how long it will be until it is released to the general public, but I am truly excited. With this release of TS you will have more power than you ever imagined you would need, and yet it is still easy to use. [more...] |

|

||||||||||||||||||||||||||||

[...more]

The market popped right back into the Range-Bound yellow box (Figure 1) today, nicely holding above the 24.40 QQQ Attractor. One of the options I mentioned on Tuesday for Wednesday's open was that it could gap down and recover upward. That's just what it did this morning. The initial move down did not quite make it to the 24.40 line, which says to me that we have a little bit of strength showing through.

My model gave a Sell signal just as price touched the lower Attractor, and I did not issue an alert because I believed it to be a fake out and thought it would bounce off the Attractor. And, it did just that. Two hours later a Buy signal was given. On this one I issued an alert, saying that price was nearing an upper attractor and that I would wait for it to be penetrated before buying. Price did subsequently penetrate the 25.11 boundary and I got long.

Today I decided to venture out a little and trade the SPY along with the QQQs. So I'm long both vehicles. I know from testing that they are in very close correlation, each echoing the moves of the other. But, trading the SPY is more like trading the S&P futures contract, except at 1/10th scale, so I'm trying it out just to get a feel for the size of the moves.

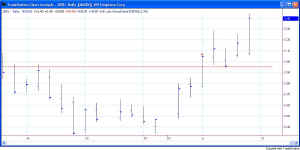

In the chart in Figure 2 you can see that I have marked the Attractors on the 15-minute chart of the SPY--on a chart produced by TradeStation 7. Notice that Wednesday's close jumped up to (and then away from) the Attractor at 87.45. The fall back was only to the midline of the Sunny_Bands, which is another show of strength.

To me it looks like a one-wave is in place with a sharp two-wave correction, and the three-wave is nearly done. Following the completion of the three-wave we should have a sideways four-wave and then the five-wave should carry us on to about 88 on the SPY.

Looking again at Figure 1, I wanted to review the yellow box. Flipping back and forth between a TradeStation 7 and a TradeStation 6 chart caused me to notice something, I think. Tell me if you experience the same thing. The enlargement of the TradeStation 7 chart is more clear than the enlargement of the TradeStation 6 chart. That would be nice if it is so.

Ok, back to the box. Since the beginning of December the QQQs have been range-bound from 24.40 to 27.85 (the yellow box). Yesterday and today were of pivotal importance. If price were going to break down, it probably would have done so by now. The QQQs have hit 24.40 3 days in a row without breaking through, and to me that is a nice sign of strength. From yesterday's commentary I drew the neckline of the Head-and-Shoulders pattern and said it extended a little higher, but right into the 25.81 QQQ area. Price today went as high as 25.45, so I think it will have a bit more to go on Thursday.

INVESTORS:

Since the QQQs are back in the box, I'm guessing that they will progress on up toward the top of the range at 27.85, testing the area to see whether they can burst on through. I have been flat for the long-term through this choppiness, but I am now willing to go long up to 27.85, and then put a tight stop under the market to allow the trend to continue to progress if it's going to do so. As long as it's moving up, I'll just hold on. My "intuition" tells me that this is the time the market will break through the box and go on upward toward the 30-35 zone. I feel it in my bones. (And, it looks like the choppiness has been a sideways 2-wave correction.)

So, as always, stay nimble, humble and take small losses and big wins.

PS - Don't forget about the new Bulletin Board. I love teaching and answering questions. So, visit often. Thanks for participating. And remember, the BB is free, but one-on-one I charge $400/hour. Why not use the free source?

![]() Updated Seminar Schedule -- click here

for new dates. Several new breakthroughs in the past two

years have given me new material to share with those interested in the

"home business" of trading. On Trader Tech U I will be

giving a ten-week course on Indicators; in Carlsbad I will be

giving several back-to-back sessions of "Solving the Puzzle",

"TradeStation Made Easy" (including the use of the new

TS7), and "Advanced EasyLanguage."

Updated Seminar Schedule -- click here

for new dates. Several new breakthroughs in the past two

years have given me new material to share with those interested in the

"home business" of trading. On Trader Tech U I will be

giving a ten-week course on Indicators; in Carlsbad I will be

giving several back-to-back sessions of "Solving the Puzzle",

"TradeStation Made Easy" (including the use of the new

TS7), and "Advanced EasyLanguage."

Make it your business. What you don't know CAN hurt you.

Weekly Stock Picks for the week beginning 1/13/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TXN | 17.50 | 16.00 | 20.00 | ||

| ADBE | 28.70 | 27.00 | 30.00 | ||

| AMGN | 50.60 | 48.70 | 53.00 | ||

| APCC | 15.65 | 15.00 | 16.75 | ||

| CNXT | 1.76 | 1.60 | 1.90 | ||

| DISH | 26.45 | 25.00 | 29.50 | ||

| INTC | 17.55 | 16.50 | 19.00 | ||

| INTU | 51.00 | 48.25 | 52.50 | ||

| MCHP | 28.00 | 26.24 | 30.00 | ||

| QCOM | 39.00 | 35.00 | 44.00 | ||

| TOTAL |

ARCHIVE:

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt=18.25 | 17.49 | 19.11 | 19.02 | $770 |

| WPI | 29.50 | 27.44 | 33 | no | |

| AHLS | 0.83 | 0.50 | 1.4 | no | |

| ASDS | 0.46 | 0.37 | 0.6 | no | |

| CNXT | 1.85 | 1.5 | 2.5 | no | |

| JDSU | 2.95 | 2.38 | 3.5 | 3.40 | $450 |

| LGTO | 5.52 | 4.33 | 7.63 | 5.87 | $350 |

| MCHP | 26 | 24 | 30 | no | |

| PCAR | 48.3 | 46.3 | 51.6 | no | |

| RNWK | 4.06 | 3.5 | 5 | no | |

| TOTAL | $1,570 |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.