NAVIGATION:

| SSS Bulletin Board |

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

THURSDAY NIGHT--January 30, 2003

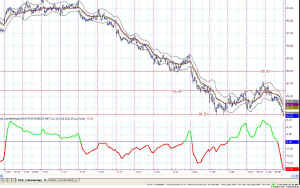

Figure 1 - Daily chart of QQQ w/ Range We are still inside the box. Today's market action was disappointing as prices snaked on down to the lower Attractor at 24.40 QQQ (84.75 SPY). But, once again [more...] |

|

||||||||||||||||||||||||||||

[...more]

price banged on the Attractor and did not go lower. Again, I read that as a positive sign. The question "what is true?" however, is best answered that the market went down today. So, the money to be made was in the short trade, not the long one.

Again I see no reason to get short for the long-term investors, but caution is surely advised. What I can say with fair certainty is that this is a dangerous market to trade.

On the QQQs, today's bar tried to form a range expansion, but did nothing except undo yesterday's gains. On the daily chart I see an Attractor just slightly lower, at 24.13 that might be tomorrow's trial.

The dip down today was much sharper on the INDU than on the other two indexes I watch, tumbling as the Dow broke 8000. It is always disappointing to see the Dow below the 8000 mark psychologically. It's especially disappointing from a technical standpoint since the next lower Attractor on the daily chart is down at about 7250. The Attractor at the 8000 mark is strong both from a resistance and from a support point of view, so it is certainly possible that this could be a momentary overshoot and not a new leg down.

TRADERS: my model is short from about mid-day today, but I ignored the trade thinking price would bounce off the attractors too soon to take much profit. Looks like I was wrong on that one. But, tomorrow morning will tell. I'll go wherever the open points.

As always, stay nimble, humble and take small losses and big wins.

![]() Updated Seminar Schedule -- click here

for new dates. Several new breakthroughs in the past two

years have given me new material to share with those interested in the

"home business" of trading. On Trader Tech U I will be

giving a ten-week course on Indicators; in Carlsbad I will be

giving several back-to-back sessions of "Solving the Puzzle",

"TradeStation Made Easy" (including the use of the new

TS7), and "Advanced EasyLanguage."

Updated Seminar Schedule -- click here

for new dates. Several new breakthroughs in the past two

years have given me new material to share with those interested in the

"home business" of trading. On Trader Tech U I will be

giving a ten-week course on Indicators; in Carlsbad I will be

giving several back-to-back sessions of "Solving the Puzzle",

"TradeStation Made Easy" (including the use of the new

TS7), and "Advanced EasyLanguage."

Make it your business. What you don't know CAN hurt you.

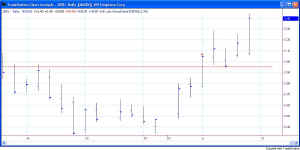

Weekly Stock Picks for the week beginning 1/13/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| TXN | 17.50 | 16.00 | 20.00 | ||

| ADBE | 28.70 | 27.00 | 30.00 | ||

| AMGN | 50.60 | 48.70 | 53.00 | ||

| APCC | 15.65 | 15.00 | 16.75 | ||

| CNXT | 1.76 | 1.60 | 1.90 | ||

| DISH | 26.45 | 25.00 | 29.50 | ||

| INTC | 17.55 | 16.50 | 19.00 | ||

| INTU | 51.00 | 48.25 | 52.50 | ||

| MCHP | 28.00 | 26.24 | 30.00 | ||

| QCOM | 39.00 | 35.00 | 44.00 | ||

| TOTAL |

ARCHIVE:

Weekly Stock Picks for the week beginning 1/5/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| UNM | mkt=18.25 | 17.49 | 19.11 | 19.02 | $770 |

| WPI | 29.50 | 27.44 | 33 | no | |

| AHLS | 0.83 | 0.50 | 1.4 | no | |

| ASDS | 0.46 | 0.37 | 0.6 | no | |

| CNXT | 1.85 | 1.5 | 2.5 | no | |

| JDSU | 2.95 | 2.38 | 3.5 | 3.40 | $450 |

| LGTO | 5.52 | 4.33 | 7.63 | 5.87 | $350 |

| MCHP | 26 | 24 | 30 | no | |

| PCAR | 48.3 | 46.3 | 51.6 | no | |

| RNWK | 4.06 | 3.5 | 5 | no | |

| TOTAL | $1,570 |

![]() AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.

AND... if you are a TradeStation user, you need to

attend "TradeStation Made Easy"

February 7-9, 2003. Sunny knows TradeStation and EasyLanguage

as only another Trader could, and the class is more engaging and jam

packed with useful information than any other class you can find, at any

price. Enroll

Now--she only takes 15 students. And, the same real-time

trading offer applies.