NAVIGATION:

| SSS Bulletin Board |

| How to use our commentary |

| FAQ |

| Member sign in |

| Free week guest |

| I want to read about the benefits |

| View Daily Archives |

| View Weekly Archives |

"The Sunny Side of the Street"

TUESDAY NIGHT--February 11, 2003

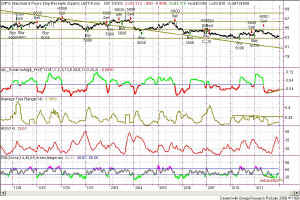

Figure 1 - 5-minute chart of SPY [click to enlarge] It seems astonishing, but we are within "inches" of hitting the lower Attractors that I set in the Table above, over a month ago. That "should" be it for the current downdraft, and a technical bounce should occur. Just at the point when traders and investors alike are ready to give up, throw in the towel, and abandon all hope, an upward move is likely to take place. Whether the technical bounce will be blamed on war, Alan Greenspan or peace is unknown, but the media will find some "fundamental" news to pin it on. I have been watching this ... [more...] |

|

||||||||||||||||||||||||||||||

[more...]

... I took this opportunity to bounce from daily charts to 5-minute charts and pulled off both long and short trades from Fibonacci retracements.

Appropriate alerts were sent before and after the fast up and fast downward moves and I hope some of you were on the watch. It was a "fun" day for small profits.

That, I think, is the key to current market conditions. Small profits as the market is undecided and continues to defy gravity in either direction.

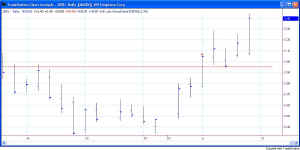

Figure 2 - SPY 5-minute trends and divergences

[click to

enlarge]

Because today did not reach down and touch the trendline on the 5-minute SPY, I expect prices to lift and touch the upper Attractor that I have set at 86.26. That would confirm the sideways activity even further, and there are several divergences on indicators that make me believe that sideways is the most probable activity still. See Figure 2.

If the market shows its hand early and begins a move upward I will be long, but very edgy around the 84.49 level, where there is LOTS of resistance and support.

So, as always, stay nimble, humble and take small losses and big wins.

![]() Updated Seminar Schedule -- click here

for new dates.

Updated Seminar Schedule -- click here

for new dates.

Weekly Stock Picks for the week beginning 2/09/2003:

| Symbol | Breakout | Stop Loss | Goal | Close if Triggered | Profit/Loss |

| ACV | 51.54 | 49.5 | 53.22 | ||

| ADSK | 15.45 | 14.81 | 16.13 | ||

| AGN | 62 | 60 | 64 | ||

| AMGN | 52 | 50 | 54 | ||

| QCOM | 38.37 | 36.67 | 40 | ||

| BDX | 33.5 | 32.5 | 34 | ||

| BEL | 7.88 | 7.06 | 9.3 | ||

| BGG | 43.6 | 42.35 | 45.48 | ||

| TOTAL |

![]()