The Sunny Side of the Street

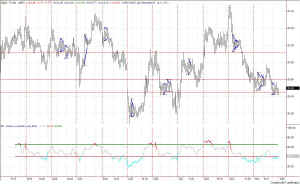

Figure 1- Daily QQQ [click to enlarge]

In

yesterday's commentary I projected that the QQQ's more likely line up for

today would be at the 24.45 level. The intraday look at today shows

just that, with the Candlesticks at the end of today lining right up with

their lower

Figure 2- 15-minute QQQ Candlebodies [click to enlarge]

bodies on the 24.45 mark. Intraday there were lots of opportunities for little profits, but no opportunities for any sizeable runs. How do I know that in advance? I don't. And, neither does anyone else. But, we can look at Attractors from the past, and see how Support and Resistance line up and reason that the markets do not go forever in one direction without correction. Yesterday left the QQQs with a sharp run downward, lining up on previous congestive failures, so I just "put 2 and 2 together" to reason that we might be looking at congestion again at the same level.

Looking at the daily (more long-range) chart of the QQQs for today, the day was lower than yesterday, but still a small, congestive day. At the end it formed (Figure 1) a 4-bar congestion pennant (by my way of drawing them). That says to me that tomorrow is more likely to do some serious movement, while today was more likely to bounce around.

So, while my intraday Alerts were fast and furious today, tomorrow they are more likely to be a single trade in the short direction. Too soon to tell, of course, but that's what it looks like from here.

Figure 4- 5-minute QQQ [click to enlarge]

--believing that the day would be choppy and only good for a few cents at a time. If you line up my Alerts with the chart in Figure 4 you can see that for the most part I was shorting at the top line and going long on the bottom line. I got out of sequence at one point, but recovered on the day.