The Sunny Side of the Street

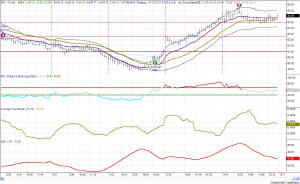

Figure 1- Daily INDU [click to enlarge]

In Thursday night's commentary for Friday, I expected the market to make a run for the next Attractor on the upside, at 26.22 basis QQQs. Friday it did make a slight run in that direction, but it didn't quite make it. In the morning it got as high as 25.98, but couldn't make it any higher. That is a negative vote for tomorrow's market. The long-term (daily) charts are still short basis the Dynamic Moving Average, because the long-term action is still virtually sideways. Since November of 2002 the QQQ has been moving in a sideways channel that has yet to be broken. See Figure 2. The top of that channel, by my estimation, is at 27.53, and that's where we should either see a strong breakout or a failure and a move back down to the bottom of the channel. The bottom of the channel is at 23.38.

Friday's prices did move above the pennant that was established on 3/4,

thereby giving a buy breakout signal on the daily chart. So, for

long-term holdings, this reading would say I could hold long positions

until the top of the box is touched.

Figure 3- QQQ 15-minute

On the 15-minute charts of the QQQ (Figure 3) and the SPY (Figure 4) you can clearly see the beautiful long and then short signals that were given on Wednesday and Friday. The current open trade, therefore, is short with 19-cents profit per share at the moment. Trading 5,000 shares of the QQQs that amounts to $950.

Again, I have to say that as long as the war issue is unresolved, the market is being played close to the vest. Not many investors or traders are willing to leave their positions exposed to overnight surprises.

The volume on Thursday and Friday was higher than average, and in fact was as high as on the last two pivot bottoms. That could signal another pivot bottom and mean that the markets can put in another 10 or so points to the upside on the SPY and about 3 points to the upside on the QQQs. On the INDU that would translate to a move ending at about 9000.

==<:>==