The Sunny Side of the Street

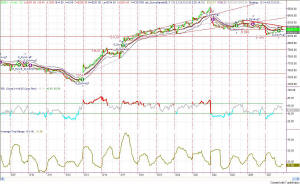

Figure 1- Daily chart of INDU

The market dropped 28.43 points from last night's close to today's close basis the Dow Jones. In last night's commentary I said:

- "My vote is for the down move to happen rather than the up move. With the eight days of solid up movement always comes retracement; and in this case the retracement to the SunnyBands midline would be a 38.2% retracement of the eight day move up, landing at 8084."

Again I was correct in the direction yet a little too strong in the point count. The market opened this morning with a 3.49 point gap drop down, and continued the motion downward for about 15 bars. The low was put in at 8104 on the Dow. So, my prediction was only 20 points off target.

Figure 2- INDU intraday 15-minute

After the anticipated target was hit, the Dow bounced back upward toward the lower SunnyBands, trying for and then accomplishing a push through the top SunnyBand. (Still Figure 1). At the same time, price hit the descending trendline that we have been watching, at 11:30 am, and deflected off and began another move downward.

By day's end, the Dow came to rest right on the midline SunnyBand, at 8190. This number is interesting since it has been hit and bounced off from in each of the last three days.

Figure 3- INDU 15-min over larger time span

To take a longer view of the market, rather than look at the daily chart just yet, in Figure 3 I have squeezed up the time frame on the same 15-minute chart so we can see more days. On this chart you can see how important the current line at 8100 is.

Yet, on the Daily chart of the INDU, the more important number is 8000. (See Figure 4). You can see that as far back as 9/21/2001 the market was bouncing off of the 8000 Attractor (with RSI getting as low as 12.85).

Now price is almost down to the 8000 line again (the heavy line), but this time RSI is in the upper range, not the lower. That should say that there is further room on the downside for RSI and price both.

While it doesn't seem a very logical day for justifying a move upward, I think tomorrow is likely to be an up-day. I am looking for the market to move above 8233 in the next day or two before it retreats again.

==<:>==