The Sunny Side of the Street

Figure 1-- Daily Dow

In last night's commentary I said:

- "Most of the time, right after April 15th, the markets pull back for a day or two to gather steam after tax day. I see no reason to expect anything different from the usual in this timeframe. So, for tomorrow I would expect a small pullback to the 26.09 line, with lots of churning for the rest of the day."

Today's Dow moved from yesterday's close at 8401, smoothly downward all day to close at 8254; down 147 points. You can't ask for accuracy any better than that!

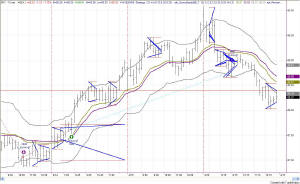

Figure 2-- SPY 15-min intraday chart

Even if you hesitated on the open of today, and waited for price to cross under the Sunny_Dynamic_Moving_Average (SDMA), the market showed you clearly where it wanted to go. As soon as it had passed down through the SDMA pennant formations popped up all over the place.

Congestion is lack of movement. The markets don't exhibit lack-of-movement for long.

And, sure as shootin', when the pennants were broken there was still more shorting to do.

Figure 3-- QQQ 15-min intraday chart

The SPY and INDU both gave sell signals earlier in the day, while the QQQ SDMA waited until the end of the day to give the signal. Nevertheless, the better trading came from knowing the daily chart after tax day for so many years, combined with the market's open at an Attractor and subsequent move solidly down from there on. Notice on Figure 3 that the QQQs hesitated midday at the 26.37 Attractor, taking about 2 hours of sideways activity before breaking back down.

The downward progress of the QQQ ended just where I said it would yesterday, right at 26.09 (actually it only went down to 26.12), from which it then took a small bounce upward. You can't ask for calls better than that!

As for tomorrow---I think we might be in for a little more bumping and grinding, as the market is carving out a spot just above the SDMA upperband and the midline, and I don't think the sell signal issued by today's bands is a good one. I think the signal will be reversed tomorrow with another run for 26.65 on the QQQs, and possibly even 26.81. That would just constitute more sideways action inside the yellow box, still with nothing accomplished. It would take a breakout above 27.19 to change the flavor of the market to somewhat bullish; it would take a breakdown below 25.33 to change the flavor to seriously bearish. Right now, the flavor is sidewaysish.

==<:>==