The Sunny Side of the Street

Figure 1: Daily Dow

Today's daily bar of the Dow looks like an upside down version of yesterday's bar. We basically retraced the same ground. Yes, it was a nice up day for intraday traders, but technically we are still in a sideways grind, testing the 8511 resistance area.

The Dow is still above the Sunny_Bands midline, which is a positive sign, and it is pushing the upper band upwards, another positive sign.

While the RSI is at 58 (above 40) it isn't above 65 yet, which is showing some weakness.

I am still anticipating the test of 8511 to turn out negative, but only the market's action will tell us what is really happening.

Figure 2: QQQ Daily

On my intraday model, the buy signal on the QQQs netted about 25 cents, which would be a little over a thousand dollars, for those of you who have purchased the indicators.

On the daily chart in Figure 2, you can see that today's action once again tested the 27.46 line, with the close of 27.47 being almost exactly on the line. My comments from last night, therefore, still stand. The most likely scenario is to test the top of the box at 28.31 and then fall back down to the upsloping trendline.

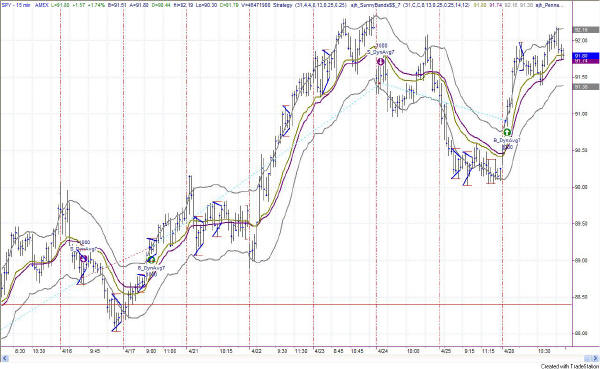

Figure 3: SPY 15 minute intraday

Figure 3 shows the intraday view of today's retracement action. The buy signal, for those of you who have my indicators, came early enough in the morning to generate a nice little profit of 90 cents, or $900 on 1000 shares. Still, it is nothing like the good ole days when the Average True Range day was $2-$3.

The day ended with the SPY closing just below the highs of 3 days ago, not forming any new highs. Because of that, I still stand by my previous commentaries watching for the markets to start a trek downwards in the near future.

Nevertheless, if any of these 3 markets I report on breaks above the "yellow box" tops, it is indication to change our tune and watch for upward movement instead.

==<:>==