The Sunny Side of the Street

Figure 1: Daily INDU

NOTE CHANGES:

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.

I have been asked by one of my subscribers to comment on a currency and the E-Mini, as part of this service. If any of the rest of you agree, please email me so I will know whether others want this service as well. (sunny@moneymentor.com) However, as part of including two more markets, I cannot say as many words about each chart without taking all day. I will of necessity be more to the point and succinct. Nevertheless, I will continue to point out critical Technical Analysis constructs and things that I see, and how I read them on each of the charts. I think adding the EuroDollar and the E-Mini are a good idea for some diversity.

In yesterday's commentary I said:

- "Some commentators are calling this "strength" and saying the market is going up strongly. I don't see it that way just yet. It may turn out that way eventally, but for me, as long as we are going sideways, that's all I can say--we are going sideways. It doesn't really look like "up" yet."

And, that's what happened today. More sideways. The markets stayed beneath the midline Sunny_Bands essentially all day long. At the end of the day, the markets took a quick run for the exits and fell, on a single bar, to the bottom Sunny_Band. (See Figure 2)

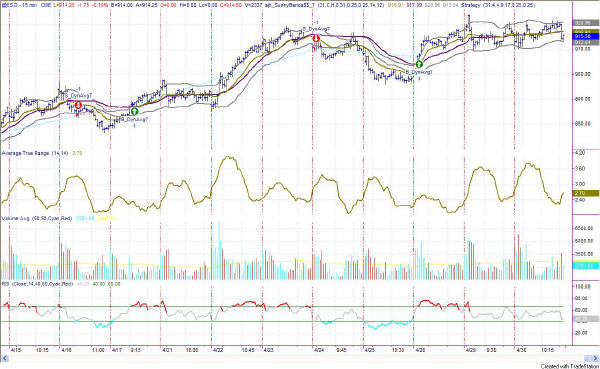

Figure 2: QQQs 15-minute intraday

My model is now short the QQQs, but again I don't think it is worth trading yet. Out of long positions, yes; into shorts, not yet. Before shorting I want to see the QQQ break beneath 27.45.

The Dow (back to Figure 1) hesitated again at the 8522 marker, not able to go above that level. Not a real positive sign, or sign of strength. Average True Range (ATR) seems to be heading back down, and today's range was a measly 96 points. The way I read it, the Dow is most likely to head down for the Sunny_Bands midline next, which lies currently at 8259.

Of significance in that prognostication is the observation that RSI is now in divergence with price on the daily Dow.

The QQQs present the same picture as the Dow, the S&P, the E-Mini: all sideways, pretty much in lock-step.

Figure 3: QQQ Daily with Yellow Box

Once again, the Yellow Box was not broken. The QQQ is still in the sideways holding pattern until it breaks the box. And, if it doesn't break it pretty soon I would expect it to begin a descent instead. One way or another it is going to end up touching the upsloping trendline beneath current prices.

Figure 4: E-Mini 15-minute intraday

Note in Figure 4 that the RSI is also in divergence with the E-Mini. While the model is officially still long, the divergence definitely speaks to an oncoming down movement. And, as I have been saying: as long as we are going sideways we will continue to go sideways until we don't.

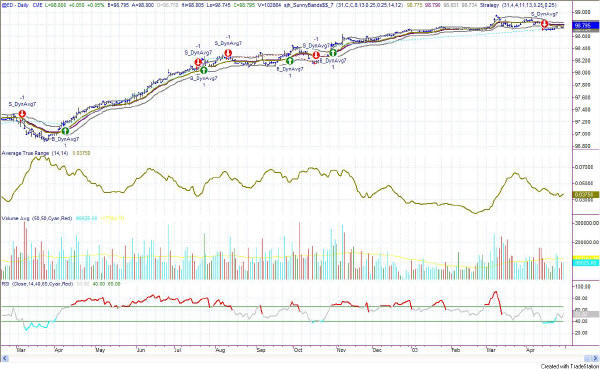

Figure 5: EuroDollar Daily Chart

After a lengthy stint on the long side the EuroDollar model is now officially short. Confirmation that it might be heading down soon is to be found in the RSI, which has divergence set up throughout the topping process. That could be read either of two ways: (a) the divergence means the ED will move down, or (b) the RSI has bottomed and the ED is now oversold and ready to move up. OK, so how do we tell? If the ED moves below 98.70 on a closing basis, the bet is that it will continue on down to the next Attractor at 98.60 and then try for 98.45. Those are the goals. If, however, it turns and heads upward, I will consider it a long play if it breaks above 98.81 on a closing basis. In that case I will be looking for the ED to make a run for the Attractors above at 98.90 and then 98.96.

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. |

I still stand by my previous commentaries watching for the markets to start

a trek downwards in the near future.

Nevertheless, if any of these equity markets I report on breaks above the "yellow box" tops, it is indication to change our tune and watch for upward movement instead.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

==<:>==