The Sunny Side of the Street

SUNDAY NIGHT - May 11, 2003

(Click on any chart to make it larger.)

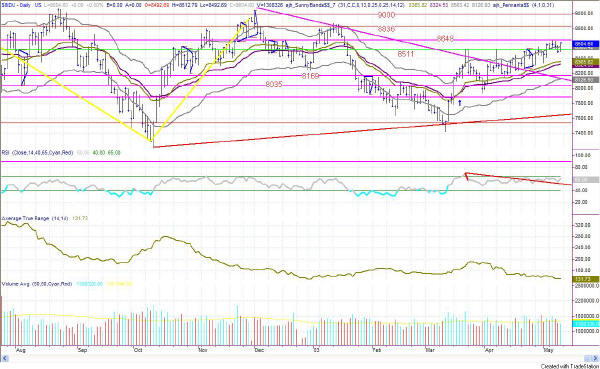

Figure 1: Daily INDU

The Dow is congesting under the 8648 line, not pushing up and over, and not dropping radically. Here again, we have some more sideways indecision going on. ATR is continuing to decrease, echoing the congestion, but RSI is still holding above 60. That's a positive sign. My model is still long the Dow from the blue arrow on the chart in Figure 1, which is a pretty good trade.

On the intraday chart the formation looks a bit like a double top, or a

Head-and-Shoulders with a double head. That would call for some more

downside action to clear out the pattern. If that happens, I think it

is likely to stop at the 8500 mark and try again on the upside.

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. |

Figure 2: QQQ Daily

The daily QQQ went over the 28.31 mark on one day's close. The other ventures over the line were just on an intraday basis. But, then on Friday it went back up through the line and closed above it. That's a positive sign.

The intraday model went into a buy signal at 7:15amPT Friday where it

still holds. The last two bars of the day on Friday were doji bars,

signaling a big reversal to follow. Since both were solid bars

(filled/solid means downward movement) the quick move on Monday has more

likelihood of being upward. Friday's close plus one Average True Range

would put the QQQ at 29.02 for Monday's close.

I see no reason to rush the gate, or jump the gun, or .... here. It's a little too early. Wait for the market to give a clue. Monday's action will be very telling. That is it will if it doesn't just go sideways again. Unless something radical happens, Monday looks like a good day to take a vacation and let the market do some talking.

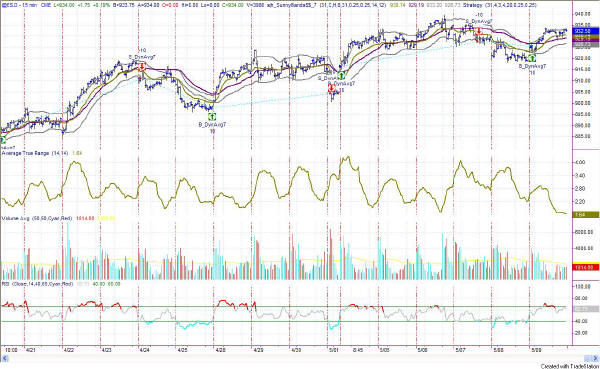

Figure 5: E-Mini Daily

Figure 6: E-Mini Intraday 15-min

Thursday was a quick single day dip, as I expected in Wednesday's commentary. Friday was the rebound day back up from the line of resistance that goes right across the pay to the exact lows of Thursday. My model went into a buy signal on Friday at 7:15amPT. Nothing has yet signaled an exit from that buy signal. Price is not as high as 3 days previous, so there is more room at the top, up to about 937 to be more exacting.

Looking at the Daily chart of the E-minis, in Figure x above, you can see the heavy line of resistance right about where we are now. So, not much room left at the top, but some. Then some drama has to take place. It's about time for the market to make a decision. Either it has to be a quick slice over and above the box, or it's back into the box again for some more sideways chop. After the next 5 points up, I'm thinking I'd be better of on the sidelines for a bit, with a little wait and see, before going long or short. There's plenty of time for the trades to come after the market shows its hand.

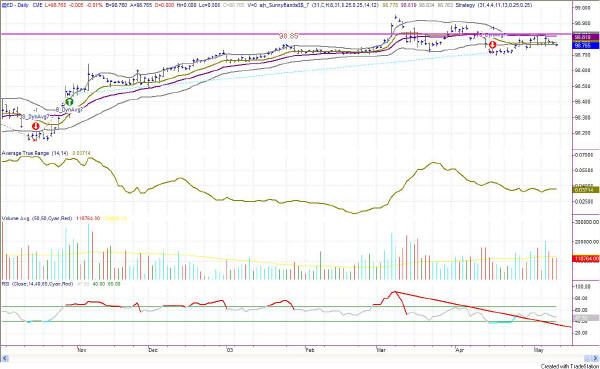

Figure 7: EuroDollar Daily - Sunday night commentary only

EuroDollar is

now beginning to show some reaction to the sell signal of a few weeks ago.

The formation looks like a rounded top now, with an impending down move.

Stay patient. Unless it goes up, it's going down.

I am now very cautiously watching the market for long plays. Since we tipped barely above the Yellow Box tops, I am alerted to potential continuing up moves. Nevertheless, I am still cautious about impending failures since the move above the yellow boxes was slight and could easily be retraced.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.