The Sunny Side of the Street

SUNDAY

NIGHT - May 18, 2003

View Archives by

Clicking Here

Weekend Stock Picks --

CLICK HERE

(Click on any chart to make it larger.)

Figure 1: Daily QQQ

We now have our fifth day wherein the QQQ could not make it above the bar I have drawn at the 29.12 level. That is not a very strong showing for the markets. I don't need to address them separately as they are all following along in tandem right now, each waiting to see what the other might do. While this lack of ability to penetrate the 29.12 level on the surface looks negative, it could very easily be a pennant formation setting up which will resolve in the direction of the flagpole preceding it, which would take the QQQs on further upward. It's too soon to tell, but we should see action in the next day or two that will tell use whether to stay long and hold on for more profits, or to get out and take the profits we have to this point.

Other than that, there's not much to say. The same thing has happened now for five days in a row, and I think I've about said it all.

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

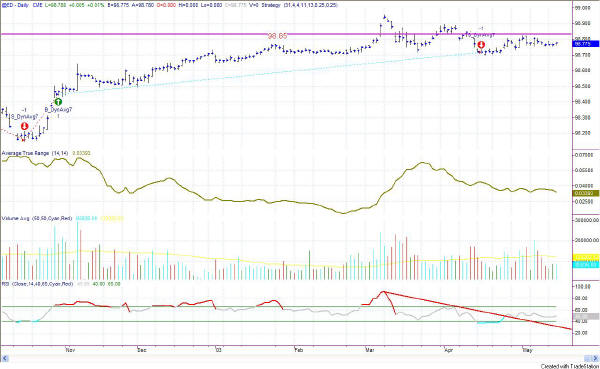

Figure 4: EuroDollar Daily - Sunday night commentary only

EuroDollar is

still on a sell signal, barely budging since last week. It looks like

it could go on up a little further before going down in response to the

signal, but currencies set up trends and take a long time to develop.

So, let's keep watching.

I am now very cautiously watching the market for long plays. Since we tipped barely above the Yellow Box tops, I am alerted to potential continuing up moves. Nevertheless, I am still cautious about impending failures since the move above the yellow boxes was slight and could easily be retraced.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.