The Sunny Side of the Street

MONDAY

NIGHT - May 26, 2003

View Archives by

Clicking Here

Weekend Stock Picks --

CLICK HERE

(Click on any chart to make it larger.)

Figure 1: Daily Dow

In last time's commentary I said:

- "The cycle drawn in Figure 5 predicted today's run up nicely, and is now nearing its crest. It probably can support one more upday before beginning to exert downward pressure, however, so watch for that. "

Friday's market action echoed my commentary by giving us a slightly up day. If you draw a line from the day's open to the day's closing bar (magenta line in Figure 2) you will see just how slight the day's up move was. Without the magenta line as a guide, visually the day looks more strongly up because of the initial down-swing at the opening bars.

Figure 2: INDU intraday 15-minute bars

The RSI stayed midrange all day on the intraday chart, giving us no indication of propensity to be bullish or bearish. The market was pretty much neutral. Again the Average True Range dropped showing us the market's lack of enthusiasm and downright drifting nature.

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

Figure 3: Daily SPY

The SPYders too are drifting. Friday's SPY was unable to make it out above the most recent high of 95.45, confirming further weakness in the SPY. If the SPY does not break above 95.45 within the next day or two, I will be looking for a break-down into the 90 area or lower. The cycle in the QQQ analysis below is the same for all of these indexes I am watching, and the comments below apply to all.

Figure 4: QQQ intraday 15-minute bars

The comments of Thursday night and the waning cycle drawn on the chart above negated any long signals given by indicators for Friday. The short stance is most likely to prevail as the cycle spends the next two days going downward. The ever-lessening ATR speaks to a big move in the making, and I believe it will be a down move because of the cycle and because of the weakening RSI.

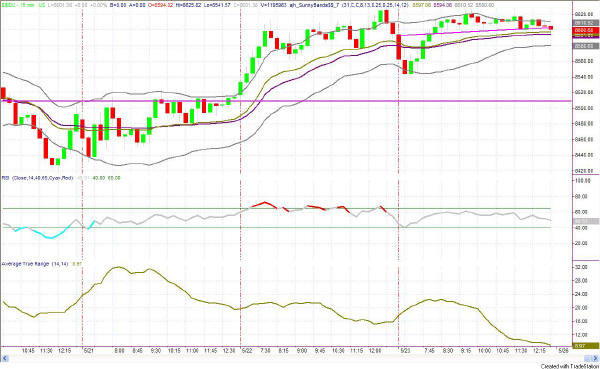

Figure 5: ES intraday 15-minute bars

The same cycle on the E-Mini that is shown on the QQQs has been moving up with the upward motion of the E-Mini, but now is putting downward pressure on the market. I expect, as in all the other charts, that the EMini will soon begin to exhibit downward pressure as well.

Figure 6: EuroDollar Daily - Sunday night commentary only

We are still in

wait and watch mode on the Eurodollar. The short signal is still in

place, but until prices drop below the magenta horizontal line at 98.85 I am

still watching. The Sunny_Dynamic_Moving_Average (SDMA) is still in

the sell configuration, with the purple line on top of the gold line, but

you can see in Figure 6 that the two lines are now almost coincident.

That could easily turn to a buy signal in the near future. If it does,

I will still be in wait and watch mode unless the ED breaks above 98.98.

Happy trading, and be very cautious. Say your prayers of thanks each day, and ask for understanding.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.