The Sunny Side of the Street

WEDNESDAY

NIGHT - May 28, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

(Click on any chart to make it larger.)

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ

Figure 1b: INDU Daily - 1 year

In last night's commentary I said:

- "It still looks to me like the market's

bullish move is topping out (in the short term) and needs at least a 1/3

correction. A correction like that would put the Dow back down around

8500 or so."

My model is still short from yesterday, with nothing from today's action changing that stance.

- Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds!

- Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value!

- Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday!

- Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669.

- How about help using or programming TradeStation? Give us a call. It's what I enjoy the most.

Figure 2a: SPY Daily - 1 year

I just noticed the inverted

Head-and-Shoulders pattern on the chart in Figure 2a. It is a bit

difficult to see, but if indeed that is the prominent technical pattern

emerging, then we should see some more activity toward the downside in the

near future, as the markets should test the neckline.

Figure 3a: QQQ Daily - 1 year

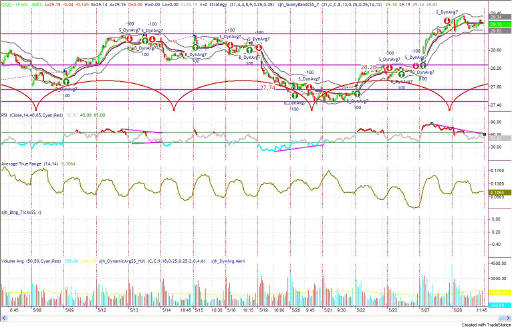

Figure 3b: QQQ Intraday - 1 day

Figure 3c: QQQ Intraday, 15-minute bars

Today's sideways activity did not negate the sell signal on the model from yesterday afternoon. Neither did it confirm much bullishness, EXCEPT that today's bar was cleanly out of the yellow box. By that I mean that all 4 data points (open, high, low and close) were outside of the box.

The magenta trendline on the RSI shows negative divergence against price. And, the cycle is beginning a climb upwards once again.

The Elliott count from Figure 3a looks to me like a 1 of a 3 has finished and we are beginning a 2 of a 3, which should (as I said last night) result in a sideways move that looks like a continuation of the channel trading that has gone on for the last couple years. If this count is correct it will burst out with a vengeance just when no one is expecting it to run the 3 of 3 upward.

Figure 4a: E-Mini Daily

Once again up against the Attractor, but this time from the Support side, the E-Mini tested the 952 level all day. In fact, you could say this was a level day. Pretty much flat for the duration. Today was one of those "Chicken Market" days, where no one is willing to take a side.

Figure 5a: EuroDollar Daily - Sunday night commentary only

We are still in

wait and watch mode on the Eurodollar. The short signal is still in

place, but until prices drop below the magenta horizontal line at 98.85 I am

still watching. The Sunny_Dynamic_Moving_Average (SDMA) is still in

the sell configuration, with the purple line on top of the gold line, but

you can see in Figure 6 that the two lines are now almost coincident.

That could easily turn to a buy signal in the near future. If it does,

I will still be in wait and watch mode unless the ED breaks above 98.98.

The bulk of the evidence weighs heavily on the side of expecting a correction, but nevertheless being in place to go long at a moment's notice. So, be sharp and on your toes.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.