The Sunny Side of the Street

SUNDAY

NIGHT - June 1, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

(Click on any chart to make it larger.)

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ

Figure 1b: INDU Daily - 1 year

Figure 1c: INDU 15 minute bars

In last time's commentary I said:

- "My technical interpretation of this is that we bumped up against the

Attractor and couldn't make it past the line."

- And, Friday's intraday market was back up again, right to the same overhead Attractor. On the daily charts we were left with a red candlestick, which means a down day, with the close lower than the open.

On the daily chart, of course we bumped up against the same line, but this time it was with a green candlestick, showing upward momentum.

I am still expecting the same framework I have been anticipating for about a week now: corrective action either down 1/3 of the move from 3/12, or a sideways pennant formation followed by a sharp move to the upside. This should take several weeks to form, and will only be negated by a move above 8836 on a closing basis on the daily chart.

While this is premature, looking out several weeks from now, I believe we will have a 3 of a 3 Elliott Wave develop, and in part the NASDAQ compared to the other indexes in Figure 1a above supports this. The NASDAQ "led the revolution" last time we had a big bull run, and will probably do the same thing again. And, at this point in time it is once again out front. So, don't get excited just yet, but be on the ready after this next correction.

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

Figure 2a: SPY Daily - 1 year

Figure 2b: SPY Daily with Technical Indicators

RSI is in the overbought

range, but the SPY closed Friday above the Attractor at

96.38. Still, I have to continue saying what I've been saying for

several days. The markets look overbought and it is time for a

correction. Whether it moves down by 1/3 or sideways in a pennant

formation is yet to be seen, but I am not holding long positions at this

time. If the SPY breaks below 94.89, it would be a good time to

consider shorting; if it continues on upward on Monday, it would

be a good time to consider going long.

Figure 3a: QQQ Daily - 1 year

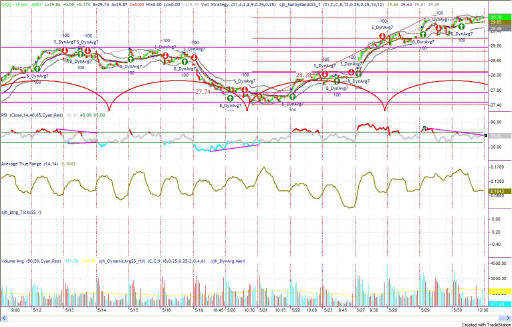

Figure 3b: QQQ Intraday - 1 day

Figure 3c: QQQ Intraday, 15-minute bars

Just like the other indexes above, Friday was a choppy day on the QQQs with the long signal being invalid due to the divergence on the RSI. Nevertheless, the QQQ did break out above the Attractor at 29.75, even if only slightly. That could spell an impending run upward, so be at the ready.

The comments from the INDU and SPY apply to the QQQ as well. I am still looking for a correction in the very near future. It will most likely be choppy going, so hold on tight. The first stop (at the 23.6% retracement level) should be at 29.19, and the 38.2% retracement level is at 28.85. The 28.85 level is the most likely stopping zone for the subsequent bounce, because there is lots of support from the 5/12/- 5/16 range.

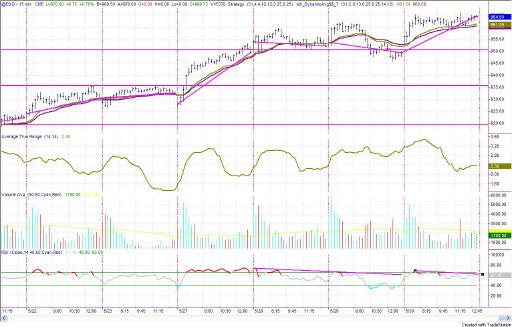

Figure 4a: E-Mini Daily

Same story, different picture. We are encountering lots of resistance moving above the 964.5 level on a closing basis. If that level is broken (on a closing basis) all bets are off and it's time to consider a long position.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

EuroDollar is now in a buy signal on the model. However, the prices

are underneath the Sunny_Dynamic_Moving_Averages. To me that is a

negative sign, which would keep me from going long just yet. With the

SDMA at 99, only a close above that would tell me to go long. Further,

the RSI is in negative divergence, and that would have to be resolved before

I would consider taking a long position.

The bulk of the evidence weighs heavily on the side of expecting a correction, but nevertheless being in place to go long at a moment's notice. So, be sharp and on your toes.

RULES OF THUMB:

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.