The Sunny Side of the Street

SUNDAY

NIGHT - June 22, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

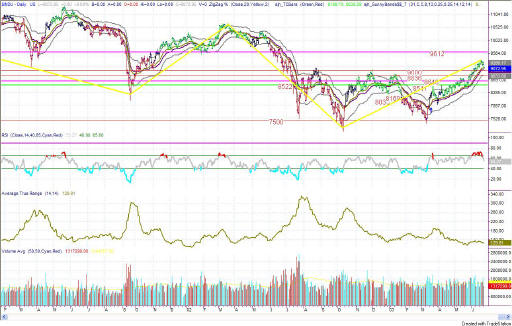

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

In last time's commentary I said:

- Friday's SPY put in a lower day on the daily chart, touching the Sunny_Bands midline. That touch is reason enough to exit long positions and wait for further news on the upside before re-entering. The touching of the midline could become a bounce, but because of the configuration of the RSI, it seems more likely that we are in for another day or two of downside activity.

Today's NASDAQ was a bit worse off than the other indexes, dropping about 2% while the other indexes dropped about 1%. As I said on Sunday night, the SPY touching the midline Sunny_Band was enough reason for me to want to get out of long positions, and I don't see anything today that tells me to go back in on the long side just yet.

Keep a book marker on Sunday night's commentary as the long range commentary from that evening will hold for many months into the future.

| EDUCATION is not expensive; lack of education is! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

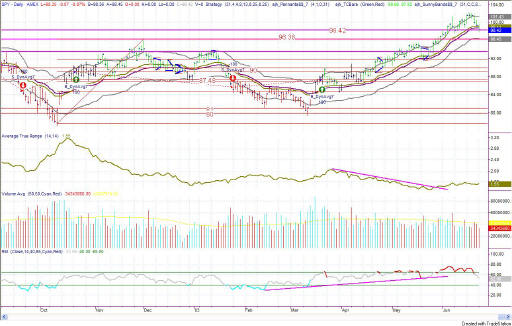

Figure 2a: SPY Daily

Today's SPY touched the 98.42 Attractor that I have been talking about -- exactly. In fact, that's where the SPY closed. Because that number is lower that the current Sunny_Band midline I believe the SPY is likely to see some continued downside action, possibly even down to the next Attractor at 96.38.

If that happens, then we know we are already into the 4th wave and the sideways to down pennant I have been talking about has been entered.

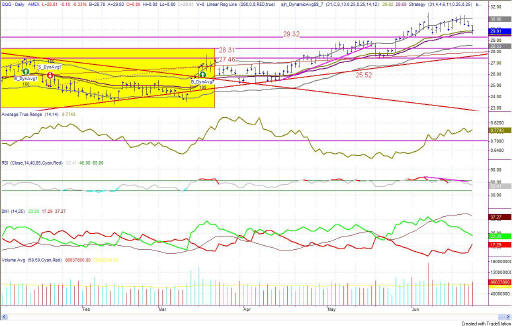

Figure 3a: QQQ Daily

The QQQ almost made it down to its Attractor, but stopped short of reaching it. Tomorrow is likely to see the 29.32 level met and even exceeded, to get the QQQ in synch with the other indexes.

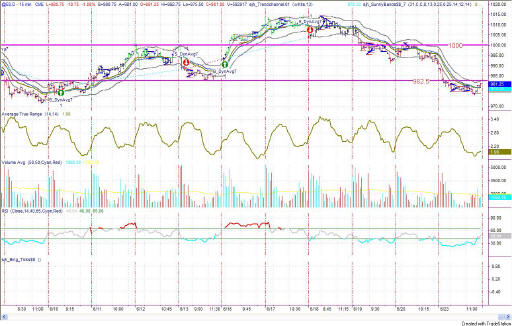

Figure 4a: EMini Intraday 15-minute bars

Sunday night I said: "The next Attractor looks like support at the 985 level, which is the most likely direction and price pivot for the next move." As it turned out, today's move headed even further down than the line of support, but then slowed down and tried to reverse gears back toward the 985 level. It made it only up to the 981.25 level, which bodes gloomy for tomorrow's market. It looks from today's action that tomorrow could be another downward day.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

current signal on the EuroDollar model is long, from 3 days ago. It's

not much of a signal yet, but rather a continuation of a long sideways

period. The RSI has been unable to reach above the 65 line

demonstrating bullishness, nor has it gone very low demonstrating

bearishness. Basically, we are still looking at a sideways market.

Stay sharp and on your toes. We have had several up-days in a row, and a correction could come in the near future. But, as long as the markets are going up, they are going up--so I'm sticking with it.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.