The Sunny Side of the Street

MONDAY

NIGHT - June 30, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

In last time's commentary I said:

- That leads me to believe that Monday will fall slightly at the open and then bounce upward, heading back up for the top parallel line.

Take a look at the EMini in Figure 4a. The initial opening was upward, but right after the open the market dropped, and then bounced back upward, heading back up for the top parallel line. The resistance at 982.5 kept price from going all the way back up to the parallel line, however, and the markets dropped once again.

What's becoming more and more clear is that we are indeed forming the pennant that I called for more than a week ago. Prices are squeezing in and going nowhere, other than making an elongated sideways wiggle.

| EDUCATION is not expensive; lack of education is! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

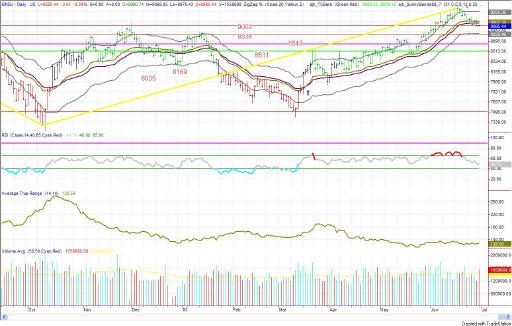

Figure 2a: SPY Daily

We are still sitting on the sidelines on the markets, having called for the exit from the long-term buy when price touched the midline in the Sunny_Bands. Since then, price has continued to fluctuate sideways, neither making any new highs nor any new lows. In fact, it hasn't even met the lower Sunny_Band yet.

Average True Range is still holding steady, neither contracting nor expanding, but just holding the same range.

Figure 3a: QQQ Daily

The QQQ, as one would expect, is following the same pattern as the other markets, however the pattern is being shown at a higher range. The QQQ prices are in the top half of the Sunny_Bands, while the SPY is in the lower half and the INDU is right at the midline.

Figure 3b: QQQ 15-minute intraday

Today's move in the QQQ intraday was really a continuation of the pattern that began yesterday half way through the day. You can see in Figure 3b that all the bars for today and the last half of yesterday were black. Black bars from the Sunny_Bands_Pro indicator mean the pattern is neutral--neither bullish nor bearish. And, that's what I called for yesterday.

Figure 4a: EMini 15-minute intraday bars

I see no Technical reasons, as yet, for the markets to expand into the 5th wave tomorrow. But, it should happen soon. Each day that we build up more and more sideways congestion now will mean a sharper upside from the pent up pressure.

The fact that the bottoms today did not come all the way down to the bottom parallel line in Figure 4a shows the beginning of the triangular formation.

Tomorrow should be more to the upside with higher lows and more choppy sideways action.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

current signal on the EuroDollar model is now short, as of Friday. I

am not interested yet in taking this signal, as it is not yet anything more

than one more sideways move in this topping action. My interest in

shorting this market will only come if the EuroDollar drops below 98.88.

Stay sharp and on your toes. We have had several up-days in a row, and a correction could come in the near future. But, as long as the markets are going up, they are going up--so I'm sticking with it.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.