The Sunny Side of the Street

WEDNESDAY

NIGHT - July 02, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

In last time's commentary I said:

- The line of support that was touched today is formed by the low on 6/26/2002, and the high on 12/02/2002. That conjunction forms a pretty strong springboard from which to bounce...

Today's Dow opened at 9043, and climbed a nice steady day upward to close at 9141. Nearly 100 points up. The daily Average True Range (ATR) is currently at 130 points, with today was just under that, making it an ordinary day.

The bounce off the springboard put the index above the midline Sunny_Band, and makes it a buy in my book. With the top Sunny_Band at 9260, that gives another 100+ points up before hitting the top band. And, I think it's off to the races now. To me it looks like (and calculates like) the end of a 4th and the beginning of a 5th is at hand.

| EDUCATION is not expensive; lack of education is! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

Figure 2a: SPY Daily

Today's SPY behaved in kind, keeping in lock-step with the Dow. Now I am watching and waiting for the Attractor at 104.84 to exert enough magnetic pull on prices to bring them up to that level, which is where I think the 5th will stop to take a breath.

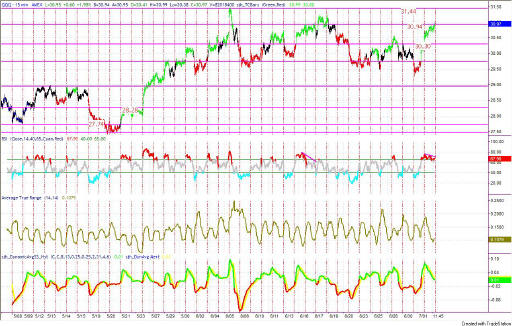

Figure 3a: QQQ Daily

Usually displaying a bit more exuberance than the other indexes, the NASDAQ (on the daily chart) flew on up to the top Sunny_Band today, leaving the others to catch up. It also pulled the bands back out of a nearly negative configuration and into a "still moving up" picture. The bands were (as I said in last night's commentary) just about to turn over, but today's price action kept that from happening.

On the intraday chart, the QQQs topped out at resistance formed by two shoulders from the last complex H&S formation. That makes it look like there is a bit more room to go at the top, to complete the move to 31.44. After that goal is reached, I am still looking for the marker at 33.79 to be the next target.

Figure 4a: EMini 15-minute intraday bars

Today the EMini blew out of the parallel channel, heading straight on upward toward the 1000 marker. I wouldn't be surprised by a return to the channel for a retest of support, but I don't think it will be tomorrow. More likely is a slight hesitation with a pump on up to the next level higher.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

current signal on the EuroDollar model is now short, as of Friday. I

am not interested yet in taking this signal, as it is not yet anything more

than one more sideways move in this topping action. My interest in

shorting this market will only come if the EuroDollar drops below 98.88.

Stay sharp and on your toes. We have had several up-days in a row, and a correction could come in the near future. But, as long as the markets are going up, they are going up--so I'm sticking with it.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.