The Sunny Side of the Street

MONDAY

NIGHT - July 07, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

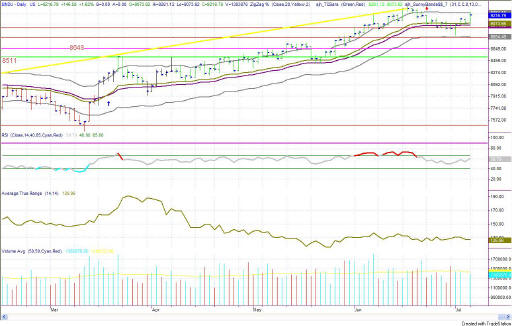

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

In last time's commentary I said:

- The daily QQQ is still touching the top Sunny_Band, giving credence to my supposition that Monday will be an up day. Even the downward movement of the pre-holiday trading didn't move the QQQ off the upper band.

TODAY: The Dow opened at 9073 this morning and closed at 9216, near its high. It was next to impossible for day traders to catch the move--one needed to be in overnight to really profit from the instant move. Most of the move, on most of the markets, went up in (as Lucy once said) "one swell foop." Then it was sideways from there for the rest of the day. Except on the QQQs. In that market, there was follow-through, and more to the move as the day progressed.

The Dow finally touched the upper Sunny_Band, bringing it more in synch with the other indexes, and giving reason to expect continued upward movement tomorrow.

| EDUCATION is not expensive; lack of education is! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

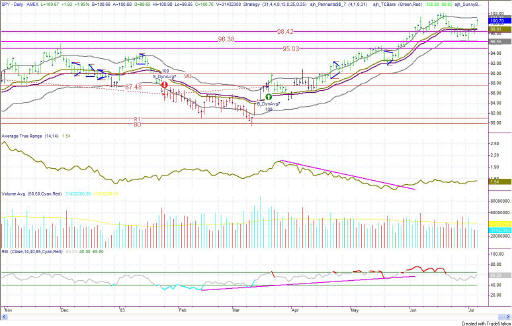

Figure 2a: SPY Daily

Figure 3a: QQQ Daily

I still think the QQQ is headed for 33, the magenta line drawn in Figure 3a. If you look at the longer term charts you can see several places where 33 has been either significant highs or lows.

Figure 3b: QQQ 15-minute intraday

The Sunny_Bands_Pro indicator was green since 7/1, except for a little stint in the black (neutral) on the 3rd. The only way to fully catch a move like this morning's is to be long from the night before. But, the QQQ continued to move up through the afternoon, giving traders another 60 cents by the close of day.

The RSI is showing a slight divergence on the 15-minute chart, and the Sunny_DynamicAvg_Histogram has given an early warning by crossing over the yellow line. Nevertheless, I am still of the opinion that the QQQ is moving to 33 before it makes a serious correction.

My opinion for tomorrow is that it will be an up day, but that it will have a little back-sliding in it. On the QQQs, we need a little retesting of the 31.44 level, and that is primarily what makes me think we might slide a bit backwards sometime tomorrow.

The old saying about gaps always being closed (or filled) will be tested as well. I don't think this gap will be closed until after the QQQ touches 33, when we will most likely get an abc correction.

Figure 4a: EMini 15-minute intraday bars

The EMini shows the most interesting chart of the day, with the spike opening settling right on 1000 and then lazing around there for the rest of the day. The fact that it settled on top of the 1000 line instead of underneath it is encouraging for tomorrow's market.

Again, the EMini shows a slight divergence with RSI, so be on the alert for sudden moves.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

current signal on the EuroDollar model is still short, with nothing yet to

confirm the signal. My interest in

shorting this market will only come if the EuroDollar drops below 98.88.

Until then, I stand neutral.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.