The Sunny Side of the Street

WEDNESDAY

NIGHT - July 09, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

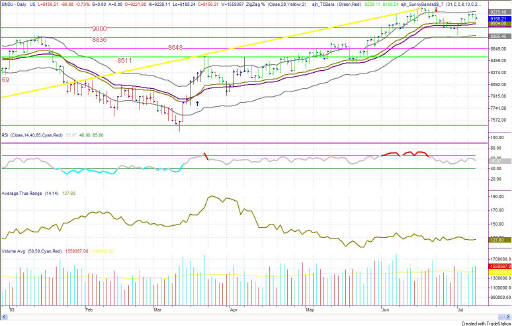

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

In last time's commentary I said:

- Doji bars can mean either up or down, but usually a sharp move. Because I am still expecting the QQQ to hit 33, I therefore expect the Dow to move up in tandem.

TODAY: The Dow opened at 9221, meandered around and then took on sharp bar's dive downward. After that (probably the reaction to the doji bar from yesterday) the Dow continued its sidewinding and closed at 9156. That put the market down 65 points for the day. A disappointing day in my book.

But, the market is currently at a tough juncture, with many stocks beginning to show 52-week highs and the climb on the 3rd wave either just about over, or already over. Watch carefully now, because only the market will tell us by its action whether it has already started the 4th wave correction. How will we know? It will go down. Simple as that. If the Dow breaks below 9000, it is moving down. If it is still moving up, it will approach 9000 and bounce upward off of the mark.

| EDUCATION is not expensive; lack of education is! | |

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

Figure 2a: SPY Daily

The SPY

Figure 3a: QQQ Daily

I still think the QQQ is headed for 33, but my confidence is beginning to wane. Psychological or mathematical...I don't know. That's why I am a systematic trader and not an intuitive trader. Right now I would be entering fear mode if I were a psychological trader, but since I follow the system, and the bars are still green, and still above the Sunny_Bands midline, long's the word.

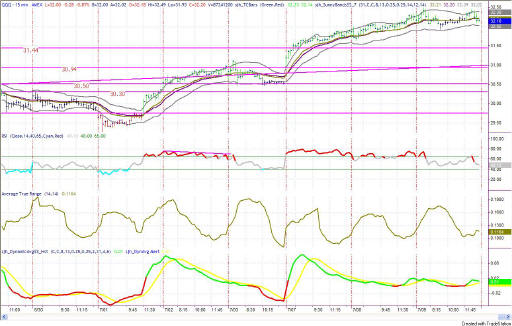

Figure 3b: QQQ 15-minute intraday

The intraday QQQ moved about as sideways as it gets today, opening at 32.17 and closing at 32.14. But, the Sunny_Bands_Pro bars are still green (even though they spent some time in the black today) and so because of that, I am still holding long.

And, if you will look at the EMini chart in Figure 4a, you can see that that market is still playing with the even 1000 mark, and basically not really breaking through it, but just re-testing and re-testing it.

Figure 4a: EMini 15-minute intraday bars

The EMini played the same game as the QQQ today, moving jerkily along sideways, right on top of the 1000 line (for the most part). The only technical aspect of note is that the pennant formation on the RSI has now been broken on the bottom, but not on the top. As long as the RSI doesn't go below 40, the market will still be in bullish formation, so I'm not terribly worried yet, but I certainly am now wary. The 4th wave may be upon us. We will know that the EMini is in the 4th wave if it breaks below 993.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The

current signal on the EuroDollar model is still short, with nothing yet to

confirm the signal. My interest in

shorting this market will only come if the EuroDollar drops below 98.88.

Until then, I stand neutral.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.