The Sunny Side of the Street

MONDAY

NIGHT - August 4, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

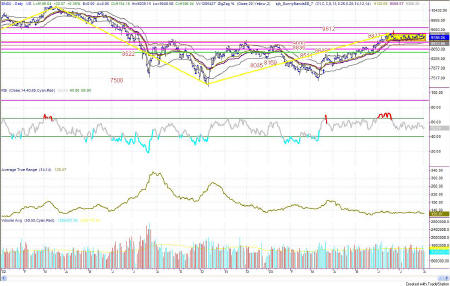

Figure 1a: INDU Daily chart

You know already what I'm going to say. The markets are still sideways on a daily basis. Continuing along the sideways winding path, the Dow and the QQQ played in a narrow range today, as did the SPX.

The Dow stayed nicely within the Yellow Box that I drew last night, opening at 9154 and closing at 9186. What ever happened to the good ole days of 300 point moves?

In my tutoring and mentoring sessions I always say that a $4,000 day is a million dollar year, and that you can set your goals accordingly. No longer true! Now a $200 day is a good day.

One of my proprietary indicators measures how long it takes to move a point. Since we have been in this 4th wave pattern, it has taken longer and longer to make a point. The ATR (Average True Range) is 0.74, meaning that that in general the market moves 3/4 point and then often turns back around without even moving a full point.

You can see on the chart in Figure 1a that my long-term position is still flat. Again, until the Dow breaks 9340 on the upside or 8982 on the bottom, I have no interest in playing with this chart. When we get to the intraday QQQ the message is slightly different.

- EDUCATION is not expensive; lack of education is!

- Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds!

- Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value!

- Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday!

- Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669.

- How about help using or programming TradeStation? Give us a call. It's what I enjoy the most.

The daily QQQ is still in a sideways movement as well. Let's set the breakout points and the "yellow box" for the QQQ.

I will be shorting if the QQQ breaks below 30.79 or breaks above 32.75. Until that time it is too difficult to play a sideways market on a daily chart.

Figure 2b: QQQ 15 minute intraday

However, on the intraday chart there are places you can easily pick up a few fractions of a point here and there, since currently you pretty much know the market is going to bounce back and forth in a narrow range.

The way I have been playing it is to sell when the RSI get overbought and buy when the RSI gets oversold. From the blue and red arrows you can see that today I jumped the gun a little bit, taking profits at an Attractor line rather than waiting for the RSI to get overbought. Oh well, it wasn't the maximum profit for the day, but it was nevertheless profit.

Now, the QQQ's RSI is in oversold territory, so I would expect tomorrow to move down in the morning and up in the afternoon.

Figure 3: SPY daily

The SPY is playing the same sideways technicality as the other charts, with one exception. The Dow and the QQQ are above the mid-line of the Sunny_Bands and the SPY is now moving in the territory beneath the midline.

This clue could mean one of two things: (a) a bounce is pending off the lower band, or (b) the market is poised to move further down.

Watch carefully for the Sunny_Bands to begin making a turn. This will let us know what is happening. This, or a break beneath the bands.

The Sunny_Bands have been as flat as a pancake for two weeks now, so there is no long-term play until we see either a move up or a move down.

Figure 4: EMini daily

The EMini is playing the same game as the SPY, as it should be. The range in the EMini is from 966 to 1011, and the Sunny_Bands continue to move straight sideways.

Watch carefully for the 4-wave to begin to reveal its end when the bands begin to show a direction. It could be a couple more weeks before the turn, so don't get impatient.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The current signal on the EuroDollar model is still short, but now at last we have the breakthrough we have been waiting for to confirm the signal.

The ED dropped below 98.88 on 7/31, which was the time to actually believe the short signal and make a move.

The next Attractor is now down at 98.7, which could be a nice profit taking opportunity. Why? Because the RSI is so low that I would expect a bounce when that level is tested.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.