The Sunny Side of the Street

TUESDAY

NIGHT - August 12, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

Figure 1a: INDU Daily chart

Up, up and away! And, yet it qualifies still as another sideways day on the Dow. Prices remain within the yellow box. No breakout yet.

Prices on the Dow are still over the midline Sunny_Bands, showing strength as we approach the upper level resistance, and the question arises whether this will be the time of the breakout, or will the Dow reflect off of resistance and dip down once again for another channel movement.

Nevertheless, today's intraday market showed some character, with a strong move in the afternoon.

| Consider this, how much can you lose on a single trade? How much should you pay for good advice? If you could make $1,000 per month trading advice that cost you $139.95 per month, would it be worth it? That's 7:1 odds! | |

| Subscribe now to The Sunny Side of the Street and SAVE. If you are receiving this commentary as part of the one-week trial and subscribe before the week runs out, your subscription will be only $99.95 per month, for as long as you are a continuous subscriber. If you wait, the regular subscription price is $139.95/month, which is still a great value! | |

| EDUCATION is not expensive; lack of education is! |

The QQQ, on the other hand, is still below the midline Sunny_Band, also still moving sideways basis the daily chart. Tomorrow will hopefully give us a clear clue as to whether we are in for more sideways action, or whether the QQQ has the strength to move up through the midline band.

I am still looking for the move to 33.00, but I don't expect it until this current resistance is broken decisively.

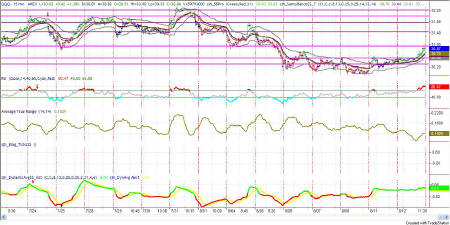

Figure 2b: QQQ 15 minute intraday

The intraday QQQ accelerated nicely in the afternoon, moving right up to the overhead resistance at the 31 level, emanating from lows on 7/25 and 8/04. My guess is that tomorrow will attempt to break that area, but will not make it clearly through as yet.

| Like the indicators I use in this commentary? If you are a TradeStation user, you can have them on your computer, so you can follow along intraday! | |

| Need a MENTOR? Sunny is available for hourly consultation, or for extended studies. Call (888) 68-SUNNY...that's (888) 687-8669. | |

| How about help using or programming TradeStation? Give us a call. It's what I enjoy the most. |

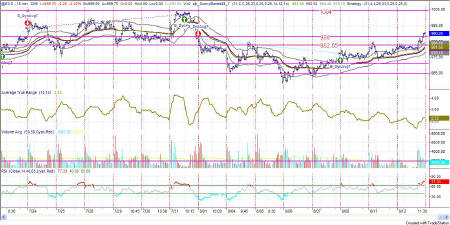

Figure 4: EMini intraday

The EMini broke through the overhead resistance at 988, showing signs of strength in doing so! My guess for this one is that the 988 level will be tested from the top side tomorrow and if it holds successfully, we will begin to see the sideways activity move into a new range spanning from 988 to 1004.

While the QQQ doesn't yet show evidence of moving into the 5th wave, the EMini does. Today's breakout could just be the beginning of the 5-wave I have been looking for. If this is it, it should run up to 1045 by my calculation.

Figure 5a: EuroDollar Daily - Sunday night commentary only

The next Attractor is now down at 98.7, which could be a nice profit taking opportunity. Why? Because the RSI has been so low that I would expect a bounce when that level is tested. The RSI itself has had a little bounce, but I expect it will use the 40 level as resistance and drop a little further from here.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.