The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

TUESDAY EVENING - August 19, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

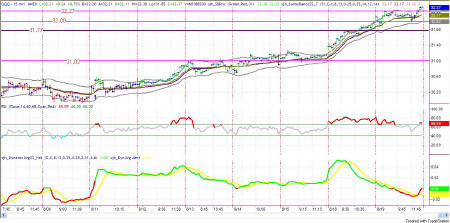

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

Figure 2a: Dow Industrials on a daily basis

The Dow opened and closed at the same place. Another doji bar! But intraday there was an excursion upward a bit, and downward exploration a bit more. And, if you look at the Yahoo chart in Figure 1a you can see that the Dow and the S&P ran neck in neck today, with the QQQ out running them both.

Nevertheless, the Dow is out of the box. And that's what is now influencing the market's direction. Yesterday I said it would probably do some testing of the top line of the box, and that's what it did today.

With a doji bar for today, that should mean a bit of excitement for tomorrow.

Figure 2b: Dow Industrials on a Weekly basis

Looking at the Dow on a weekly basis (Figure 2b) gives us a broader perspective, and makes it clear that there is more room at the top. The next Attractor upward lies at 9801 which is the square of 99, which is nearly the square of 10. It all fits in Gann-wise. Additionally, at 9801 there is a lot of overhead resistance which will draw prices there to test the line and see whether it can be broken.

Figure 2a: QQQ Daily

On a daily basis the QQQ is on the buy side of the Sunny_Bands, that is on top of the midline. The Sunny_Bands have just started to turn upward from day after day of sideways movement, and I expect this upward motion could last several weeks, although it will surely be "climbing a wall of worry."

Yesterday I said: "My expectation now is for the QQQ to make a run upward to the next higher Attractor at 32.27." And today it did just that, hesitated for a few bars and then drove even higher to close at 32.37.

I also said that "I expect tomorrow to break the 13 day old resistance," which it did by breaking the old high of 32.33 with a new high of 32.38.

Today's sideways to downward activity midday gave the RSI a cooling off period and let it drift down away from its overbought highs. However, this put the RSI in divergence with price on the 15-minute chart.

Twenty five days ago the QQQ put in an intraday high of 32.75, which seems then next logical target for the market now to aim for. The only thing holding it back is the divergence in the RSI. One Average True Range from today's close would put the QQQ at 32.93, which would exceed that old high and have people screaming "bull". So, that's my guess for tomorrow.

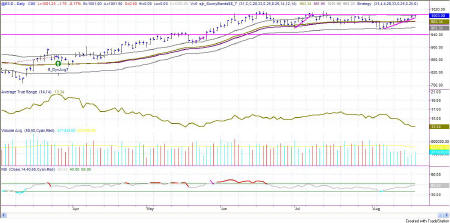

Figure 3a: EMini Daily

Yesterday I said: "It looks like a pretty solid Attractor, but I think the rise will continue to the Attractor at 1004, which is much more solid." And, indeed, today's rise on the EMini headed right for the 1004 Attractor, but stopped short, closing at 1003.50. Of course, you know what that means. The Attractor has not yet been met, so the market still needs to go on up, at least to the 1004 mark to test that level.

Figure 3b: EMini Intraday

RSI still has room on the upside, since even in this "bullish" move the RSI

has lingered midrange in the 40-65 Connie Brown area. I think it will

have to move on up and over 65 before we can call it overbought.

Figure 4a: US TBonds Daily

The bars on the chart in Figure 4a still show red, and lots of it. That means that closing prices are below the midline of the Sunny_Bands, where they have stayed since the sell signal at the top of the turn on 6/20/2003. There has been some slowing and wavering as the Attractor at 105 is being tested. And, now there is a pennant formation denoting congestion, as well. With RSI holding solidly below the 40 delimiter, I think the fall is slowing down and could easily become a sideways move for a while as the Attractor gets more testing.

Today's move went as high as 107.5, closing at 107 11/32, and

touched the midline Sunny_Bands. That makes it look to me like it is

beginning to put in a base. The RSI is sloping upward, now in positive

divergence with price, which should technically at least call for another

few days of sideways to upward movement.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.