The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

TUESDAY EVENING -

Sept 2, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

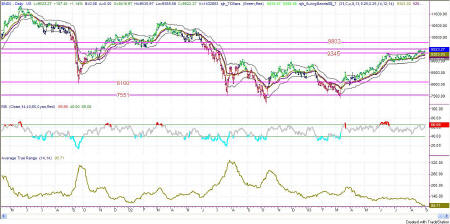

Figure 1a: COMPARISON: DOW vs SPY vs NASDAQ (Intraday)

Figure 2a: Dow Industrials on a daily basis

The Dow went right to and then surpassed the Attractor I had drawn at 9513, closing just beyond there today at 9523. As I said in last night's commentary: "The Dow is now back above the critical testing at 9345, heading back for the Attractor at 9500." And, by golly it made it all in one day... just like the good ole days.

The RSI is at 66.66, giving more room on the upside for the Dow to

travel tomorrow. While the other markets look slightly

overbought, the Dow looks like it could continue on upward to the 9802

Attractor.

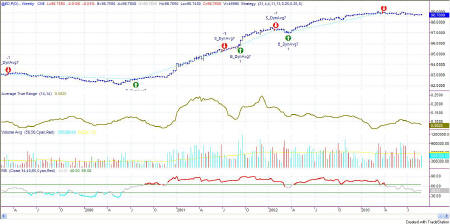

Figure 2a: QQQ Daily

The QQQ was not as exciting today as the EMini, only running to 33.88 for the close. Don't get me wrong, I'm thankful for that run, and hope it means the markets are changing flavor, but there was a bit more bang for the buck in the SPY or the EMinis.

The next Attractor is still up at 36.97, and it will take quite a few days like today to get up to that mark.

Figure 2b: QQQ 15-minute Intraday

The RSI on the daily and the intraday charts both is above 70, and in solidly bullish territory. It could easily stay that way, even going on up into the 90s, if we are about to experience a bull run. On the other hand, if the market wants to play some more of the sideways game the RSI could be the excuse and pull prices downward at any time. Be alert and aware, and let the market take you out. My system has been long since 8/26, when the signal was given and the signal price was exceeded. That's four full days now of being in one long trade.

One piece of evidence points to the markets changing flavor: long trades last much longer now than short trades do. The longest recent short trade on the system was for 1.5 days, while the long trades are lasting 3-4 days. That speaks bullish to me.

Figure 3a: EMini Intraday and Daily

Today was a great day for traders, just like to good ole days. The market picked a direction and went there, heartily. The Attractor at 1010 gave the market a bit of a pause as it stumbled and then went sideways there for a bit. But, then it got back on course and made the run for the close at 1022.50.

The next upward Attractor is at about 1041, so anything goes for tomorrow.

I was expecting a bit of a correction this morning, but didn't really get it, and with the RSI holding so high, a correction in the near future is reasonable. However, when bull markets run, the RSI can stay high for long periods of time. The only way to play this is with trailing stops. Let the market run while it's running and let a stop take you out. Where? At the midline Sunny_Bands, of course, which is just beyond where the market would normally move in the normal course of events.

Figure 5a: EuroDollar Weekly

The long-term nature of trends in currencies

still has us short the Euro. Bit by bit it keeps drifting on downward,

but nothing in a hurry. In the general nature of currencies, this

trend is taking a long time to get established and a long time in the

trending.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.