The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

TUESDAY EVENING -

Sept 16, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

$44,893 in Stock Picks to date! Click Here to view.

Figure 2a: Dow Industrials on a daily basis

LAST TIME I SAID: Another strong reason not to go on upward just now. Prices barriers like this are often tested for weeks before a break through, with the whipping and sawing going on until one side or the other gives up. Wrong!

Today's move put in a nice firm run up through the overhead resistance at 9504 and making a stretch for the next Attractor which lies at 9614. I would expect that level to be achieved tomorrow morning.

As it often is with pennants, and other areas of congestion, the reaction is strong. You can see that my pennant indicator drew in the pennant over the past 4 days, with the red line on top being the resistance. The Dow popped nicely through the line!

The next resistance is at the tops of last week, with 4 tops touching 9614.

RSI is pointing in the climbing direction, which looks hopeful for a nice move tomorrow.

The next Attractor above that level, is at 9682, which was formed last February and June.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

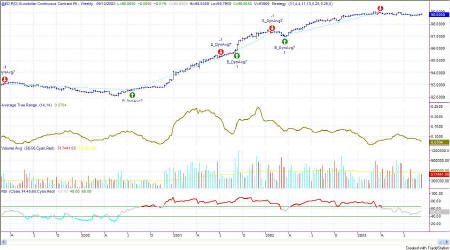

Figure 2a: QQQ - Daily Chart

LAST TIME I SAID: RSI on the daily chart is moving down slightly out of bullish territory, but is still strong. The ATR is at 64cents, and I am expecting a move of that size.

My system, on the 15-min QQQ chart called for a open position holding overnight, suggesting tomorrow might be an up day.

If so, it will have to be a strong one to make it over the VERY strong resistance Attractor on the Weekly chart.

Figure 2b: QQQ 15-minute Intraday

And that's exactly what happened today.

Prices slammed right through the resistance overhead at 34.15 and 34.22 and

went on upward to close at 34.40. The next level up is at 34.56.

With the RSI strongly above the 60 line, at 83.55, it could easily indicate

strong resistance at the 34.56 line, however. While RSI can, and in

strong bull markets often does, stay for long periods above 60, and even

above 80, I question whether this is a strong bull market. QQQs have

been moving in a sideways channel since 9/3, and until the market breaks

above 34.56, we will likely continue the sideways churning. I'm long

since yesterday, and holding overnight, but cautiously. Any downward

move tomorrow and I'm out!

Figure 3a: EMini Intraday and Daily

TIME BEFORE LAST I SAID: The next Attractor on the upside lies at about 1027, which is probably too far for a single day's run, as it is beyond 1 ATR from the current close. So, I'm expecting an up day, but only half way up to the next Attractor.

So, I'm off in my prognosis by one day all the way around. The EMini closed today at 1027.75.

The next Attractor upward is at 1029, and again I think that's too much for a single day's move, but it's possible.

RSI, as on the other charts, is strongly in bullish territory, and the top of the price channel lies at 1031.25. So, until the EMini breaks through that line, we can expect to remain in the channel. However, if it breaks out and makes a strong run up, the next level on the EMini is at 1044.63.

Let the market talk to you. If it's going up, it's going up. Any attempts to short should be made when the market tells you it's going down, by moving below the 1023.65 level.

Figure 4a: US TBonds Daily

Bonds prices moved nicely above the Attractor on an intraday basis, but moved back down to the Attractor for the close.

The suggestion from the commentary of the past week seem to be panning out! I was thinking that a rounded bottom was forming, and indeed, we now have a buy signal on the model.

Price is currently right on the Attractor at 107.97, so in all likelihood there should be some testing and retesting going on for the next several days to weeks. The market will want to see just how solid this Attractor is. Backing and filling is likely.

If the Attractor holds tight, and I think it will, the next step would be for price to head on upward to the next Attractor, which is at 112.80. Stops placed for protection could nicely be put at the SDMA (Sunny_Dynamic Moving Average) line which is currently right at 105.91.

Figure 5a: EuroDollar Daily

The long-term nature of trends in currencies

still has us short the Euro. Bit by bit it keeps drifting on downward,

but nothing in a hurry. In the general nature of currencies, this

trend is taking a long time to get established and a long time in the

trending.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.