The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

WEDNESDAY EVENING -

Sept 17, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

$44,893 in Stock Picks to date! Click Here to view.

Figure 2a: Dow Industrials on a daily basis

Could we please have another reversal day of confusion? Hit me again.

First the Dow goes up and breaks through resistance, then the very next day there is no follow through and instead the market goes in the opposite direction. That tells me we are looking at another period of congestion and indecision. The only way to trade that is to still be in the long-term buy shown in Figure 2a above. There's really no reason to change positions on the daily chart of the Dow until and unless the trendline I have drawn in gets violated.

Right now the market could just as easily go up as down. But, if it heads down I expect it would get stopped by the trendline and bounce upward again.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

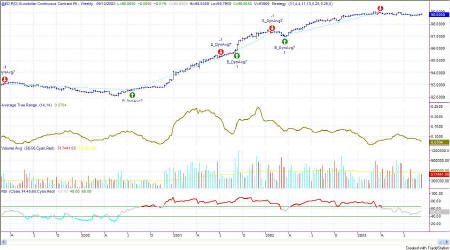

Figure 2a: QQQ - Daily Chart

RSI on the daily chart got a little relief today, while price did not really move that far downward. So, I'm looking at the current configuration as divergence, which could call for a little more movement on the downside. However, since bond prices were up today, that's good for equities and could just as easily ignore the divergence and keep on climbing.

Today's close plus 1ATR would put the QQQ at 34.94, and close minus 1ATR would put it at 33.58. Those are the ranges to watch for tomorrow.

As you can see from the chart in Figure 2b, my protective stop

Figure 2b: QQQ 15-minute Intraday

took me out near the top of the move

today, and signaled a long re-entry near the bottom. So, once again,

I'm holding long cautiously overnight. Any move to the downside

tomorrow will break through the Attractor at 34.16, and if it's on a closing

basis, I'm out, to wait and see what's next.

Figure 3a: EMini Intraday and Daily

RSI on the intraday chart was given the relief it needed to take the pressure off the high range it was in. At the same time it let off steam, it also created a divergence, which told the story of what was to come next: a more downward move toward the close.

During the latter half of the day the EMini played with the Attractor at 1023.65 before taking a small bounce near the close.

The next Attractor on the upside lies at about 1027, with the major Attractor being at 1029.75. On the downside, the Attractor is at 1018.65.

YESTERDAY I SAID: "Let the market talk to you. If it's going up, it's going up. Any attempts to short should be made when the market tells you it's going down, by moving below the 1023.65 level." And, today that was the very area it spent time testing.

Watch carefully for that level to be broken tomorrow which would move us down 1ATR, or a bounce to take place which should move us 1ATR (about 11 points) upward.

Figure 4a: US TBonds Daily

The first green bar in a long time! Today's move up caused the indicator to paint the bar green, signifying that the Sunny_DMA has crossed over into the buy position.

At the same time price broke through the Attractor at 107.97, giving a buy signal from that viewpoint.

Bonds moving up means interest rates moving down, as I've said before, which is good for the equities markets. Interest rates moving down usually means equity prices will rise. So, that's a good thing.

Watch closely and be wary incase the breakout shows itself to be false. Then if the profits begin to build, put a trailing stop under the ride up, 1.5 ATRs away from price.

Figure 5a: EuroDollar Daily

The long-term nature of trends in currencies

still has us short the Euro. Bit by bit it keeps drifting on downward,

but nothing in a hurry. In the general nature of currencies, this

trend is taking a long time to get established and a long time in the

trending.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.