The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

TUESDAY EVENING -

Oct 07, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

| Anyone interested in posting comments or questions to the bulletin board may click here. Sunny personally answers each question or comment posted. | ||

I am conducting two seminars in January, if enough interest is shown. The seminars are intense workshops in which we not only follow a strict and intense agenda, but in which we take your specific questions and problems and work them into the content of the workshop. I will cover in depth the specific techniques I use that have been successful over the years, and show the ones which are not. I've been through the mill over the last 22 years, why should YOU have to reinvent the wheel? Interested? You send me your issues well in advance of the seminar and I tailor the discussions to address your issues. Only 15 people are allowed to come, and you'll be pleasantly surprised how much we cover in-depth. Click Here to view the agendas of the seminars. |

|

|

$56,893 in Stock Picks to date! Click Here to view.

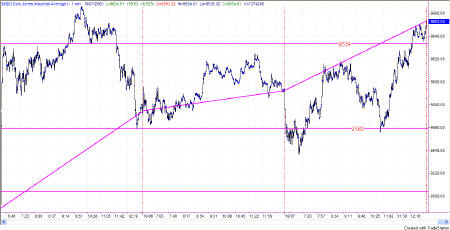

Primarily between the two Attractors today, but at the end of the day we had a little breakout, which was immediately tested and then ended on a bounce.

The Dow played most of the day between the lower Attractor at 9560 and the upper Attractor at 9633 again today. But, it did it with some omph! There were 3 nice trading opportunities today as the market moved directionally each time.

The pennant I observed yesterday was broken today, to the upside, giving us the direction at least. Now we are waiting for the power to get behind it and break the two previous highs. The high of 10/03 has not quite been broken, which is what I call the "backside of the triangle". When that breakout occurs on my pennant trading strategy is when I get long. Then I raise the stops with each subsequent pennant top until getting stopped out. To me this looks like a nice short-term play on the long side.

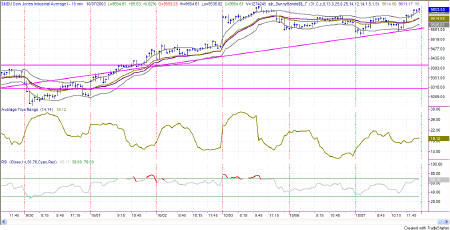

To further confirm this conjecture, RSI is up against the 65 line with a bit further to go to repeat recent patterns, and on the

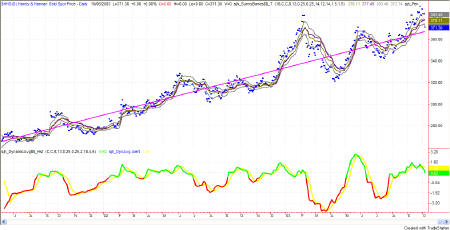

daily chart of the Dow price is hugging the top Sunny_Band and pushing it upwards in a show of strength. Furthermore, price is now above the long-term daily trendline, and price is fast approaching the Attractor at 9722.

All of these analyses go for the QQQ, the EMini and the SPY as well.

The chart in Figure 1d shows the EMini going, in effect, sideways for the past 3 days with lots of invalid signals due to the choppiness. Each time a signal comes we wait for a higher high in longs, or a lower low in shorts before taking the trade, so most of the signals weren't taken. The EMini is now poised to breakout of the Attractor at 1037.61, which of course is "dangerous" in that it could just as easily use the Attractor as resistance and drop back down. But, because of the pennant formation shown yesterday and on the other charts, I think it is time to go higher. Calling us upward is the Attractor at 1050, which is both past resistance and past support. That's where I think we are going, and where the market will have a stutter before it can break out.

Gold's down again today, but nothing more that the usual play for the midline. It should reach the midline, drop slightly under it, and then bounce back up for another attempt at a new high.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

PHW: Potential Hourly Wage. A term coined by Sunny to examine whether trading for a living is really worth it when compared to the minimum wage standard. Before considering a trading system to be a success, it should pass the PHW test.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

Sunny_Band: Sunny's Dynamic Moving Average plus 1.5 ATR and minus 1.5 ATR, creating a band on either side of the SDMA.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.