The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

THURSDAY EVENING -

Oct 09, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

| Anyone interested in posting comments or questions to the bulletin board may click here. Sunny personally answers each question or comment posted. | ||

I am conducting two seminars in January, if enough interest is shown. The seminars are intense workshops in which we not only follow a strict and intense agenda, but in which we take your specific questions and problems and work them into the content of the workshop. I will cover in depth the specific techniques I use that have been successful over the years, and show the ones which are not. I've been through the mill over the last 22 years, why should YOU have to reinvent the wheel? Interested? You send me your issues well in advance of the seminar and I tailor the discussions to address your issues. Only 15 people are allowed to come, and you'll be pleasantly surprised how much we cover in-depth. Click Here to view the agendas of the seminars. |

|

|

$56,893 in Stock Picks to date! Click Here to view.

As is often the case after a congested period, the market blasts out from its triangle, often continuing to climb. Today was a bit like that, bursting out of the congestion, but then at midday tumbling back down nearly to the area of congestion out from which it broke.

Where was the money? There were two trades: the long coming into the day, and a short trade from the top. How would you catch them? Well, here's my way of analyzing it: (I'm going to do it on the QQQs for simplicity. It translates just the same way to the other indexes.) Also for simplicity, I'm going to analyze this as a day trading scenario, not as one carried over from yesterday.

The weekly chart, on a closing basis, is above the Sunny_Bands midline. Even stronger, it is touching the top band. Vote 1 is bullish.

On the daily chart, the QQQ is above the Sunny_Bands midline, and is above the upper band. That is a sure show of strength. RSI is in the bullish zone, high between 40-65. Price is above the horizontal line formed by the most previous pennant. The SDMA Histogram just turned bullish. Therefore, vote 2 is bullish.

On the 60 minute chart, price in general has been above the top Sunny_Band, but prices yesterday only stayed above the midline. That's a show of a bit of weakness, but not enough to go short. A pennant was formed yesterday, so I draw a horizontal line across the top of it at 34.52, and will use this number to stop me into any long positions for today. The SDHA_Hst is not is a positive position, but the configuration is getting very narrow and could crossover soon. RSI is high in the range, which is very strong. Vote 3 is bullish to conservative.

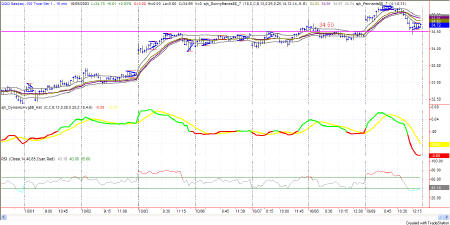

Figure 1e: QQQ 15 minute trading chart.

The open of the day answers Votes 1, 2, & 3 with a breakout above the Sunny_Bands and a breakout above the top of the 34.50 triangle line. Here's where I would go long. Price on the 15-minute chart stays above the Sunny_Band and RSI climbs above 65, for the first half of the day. At 930amPT another triangle forms, showing congestion and that any break below the bottom line of the triangle would be an excuse to get out. At 1015amPT price breaks below the triangle and 1115amPT closes below the lower Sunny_Band. This would be the place to go short. The bands have been violated. When the line across the chart was again touched (34.50) by the low at 1215pmPT is where I would take profits from the short and stand aside until tomorrow's game. Notice also that at about the same time as the triangle formed midday, the SDMA_Hst crossover into bearish formation. Yet another signal to short at that point--or at least get out of your longs.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

PHW: Potential Hourly Wage. A term coined by Sunny to examine whether trading for a living is really worth it when compared to the minimum wage standard. Before considering a trading system to be a success, it should pass the PHW test.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

SDMA_Hst: Sunny's Dynamic Moving Average presented in a histogram format where the line representing the difference between the two SDMA lines turns from red to green when the two SDMA lines cross each other (the difference is zero). The yellow line is an average of the histogram line.

Sunny_Band: Sunny's Dynamic Moving Average plus 1.5 ATR and minus 1.5 ATR, creating a band on either side of the SDMA.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.