The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

THURSDAY EVENING -

Oct 23, 2003

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

| Anyone interested in posting comments or questions to the bulletin board may click here. Sunny personally answers each question or comment posted. | ||

|

|

Any readers who are local to the Los Angeles area: I will be speaking to the Newport Beach chapter of the DayTraders USA group this Saturday morning at 8:30am. I will also be lingering in the area after the talk for a couple of hours (due to schedule conflicts with my ride) incase any of you want to hear more. Click here for more info. |

$57,979 in Stock Picks to date! Click Here to view.

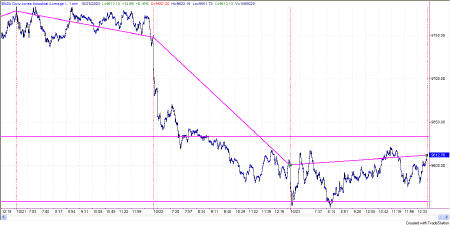

Figure 1a: 01 Minute Dow

I wonder whether any studies have been done to see if the reverse is true. If a congested day tends to produce a high moving day following, does a high moving day then produce a flat day following?

We have seen several of those in the past few months, but I haven't seen any systematic studies to prove or disprove the theory.

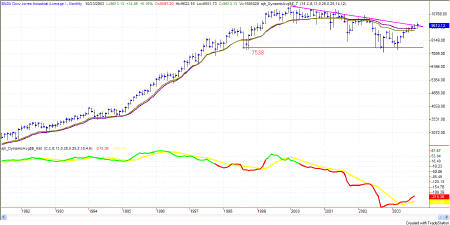

Figure 1b: Monthly Dow pennant

The monthly chart hasn't changed. The current close is still sitting on top of the pennant trendline, and the SDMA_Hist is still in a very low (and I think very powerful) buy position. I think the chart will break out to the upside, but it is taking its sweet time to do so.

This chart very nicely shows several Attractors acting as support and resistance, explaining why we are "stuck" in the current market position. On the EMini, 1050 is acting a a line of resistance overhead, and is doing a good job of keeping the EMini from going much higher. However, when it breaks out it should do so powerfully. On 5/8/2002 1050 was a line of support, holding up the EMini; and on Halloween 2001, 1050 was again a line of support. While it did not get down quite as far as 1050, nevertheless it acted as support during February 2002. My expectation is to see weakness take the EMini down to the next Attractor at 954 and then bounce back up to the 1050 level and beyond. This past two years that has been the tendency--channel trading with little to no quick progress. The progress is there, don't read me wrong, it is just not very quick. The next near-term move I expect to see is for the EMini to pop on down to the lower Sunny_Band, which is currently sitting at about 1015.

While I say this, I am still cautious of the weekly EMini which is sitting at the top of its Sunny_Bands. But, it is sloping downwards, which is why I'm thinking of a small correction in the making.

While we see the rounding top on the EMini 15-minute chart (Figure 1d), we also see that the daily bars (subgraph 2) are beginning to show below the Sunny_Bands midline. These signals are both bearish in nature and for me confirm the possibility of a retreat to the 1008 Attractor (Figure 1e)

Another confirmation: RSI is in divergence with price, hinting at a move downward along with the SDMAHist which has flattened out to a non-event sort of curve.

Gold bounced nicely back up today, with the SDMAHst turning within the pennant even before touching the bottom line. That's positive! Breakout time is nearby, if it is going to happen it should be soon.

Bonds are on a small rise again. They are rising in price without first going down to the downsloping trendline. Positive! Rising bonds, means falling interest rates, means a higher market. Stay on the alert.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

PHW: Potential Hourly Wage. A term coined by Sunny to examine whether trading for a living is really worth it when compared to the minimum wage standard. Before considering a trading system to be a success, it should pass the PHW test.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

Shooting Star: A candlestick pattern discussed further under Reference, Candlesticks.

SDMA_Hst: Sunny's Dynamic Moving Average presented in a histogram format where the line representing the difference between the two SDMA lines turns from red to green when the two SDMA lines cross each other (the difference is zero). The yellow line is an average of the histogram line.

Sunny_Band: Sunny's Dynamic Moving Average plus 1.5 ATR and minus 1.5 ATR, creating a band on either side of the SDMA.

Vehicles: Trading symbols. IBM is an equity vehicle; SPU03 is the SP futures contract that expires in Sept of 2003; @ES.D is the EMini; mutual funds are vehicles; gold is a trading vehicle; etc.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.