The Sunny Side of the Street

TECHNICAL ANALYSIS EDUCATION: EXPLAINED AND DECIPHERED FOR NEW AND

VETERAN TECHNICAL ANALYSTS ALIKE.

TUESDAY EVENING

- Jan 27, 2004

Archives of Past

Commentaries . How Did We Do?

Weekend Stock Picks --

CLICK HERE

| Anyone interested in posting comments or questions to the bulletin board may click here. Sunny personally answers each question or comment posted. | ||

|

$74,599 in Stock Picks to date! Click Here to view. Available Sunday nights.

Yesterday's rush over the 10687 Attractor made a good showing, but didn't hold today as the market turned back around and headed south. It looks like the Attractor took precedence after all.

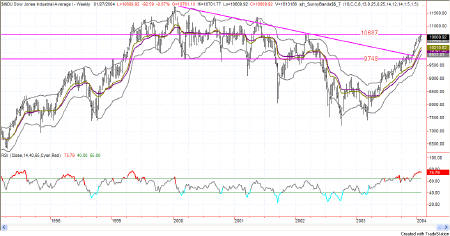

On the long-term, I am still expecting a 1000 point sideways channel to develop, which will take months in the developing. Be careful of any attempts to hold onto positions too long, as the market could give some wild whipsaws in through here.

Figure 2: QQQ 01 minute intraday

On the day, the market was nicely down, yielding a single smooth short trade. For most of the day price stayed beneath the Sunny_Bands, and downward motion was finally stopped at the Attractor from the gap opening last week.

Figure 3: EMini 01 minute intraday

The same sort of day was evident on the EMini, with the price drop stopping at yesterday's midday range. That seems like a bit of a show of strength to me that it didn't drop any further.

On both the daily charts you can see the hesitation evident in the current congestion of the QQQ and the EMini. Both RSIs have shown negative divergence, calling for a bit of a pullback in here. I get the feeling that the pullback is not likely to be harsh, but rather a showing of congestion, as I have mentioned on the weekly chart of the Dow.

With the long-term trendline still below current price action, there is some pull on price both from that Attraction and from the lines in Figure 5 which come from several years ago.

Keep your senses about you and use strict discipline in trading. Trading is a risky business.

Attractor: a level to which prices seem to be drawn, like a magnet. Usually these are lines of support or resistance from previous highs and lows, but can also be an important level on an indicator, or the edge of a Sunny_Band.

PHW: Potential Hourly Wage. A term coined by Sunny to examine whether trading for a living is really worth it when compared to the minimum wage standard. Before considering a trading system to be a success, it should pass the PHW test.

RSI: Relative Strength Index (TradeStation function)

SDMA: Sunny's Dynamic Moving Average (proprietary)

Shooting Star: A candlestick pattern discussed further under Reference, Candlesticks.

SDMA_Hst: Sunny's Dynamic Moving Average presented in a histogram format where the line representing the difference between the two SDMA lines turns from red to green when the two SDMA lines cross each other (the difference is zero). The yellow line is an average of the histogram line.

Sunny_Band: Sunny's Dynamic Moving Average plus 1.5 ATR and minus 1.5 ATR, creating a band on either side of the SDMA.

Vehicles: Trading symbols. IBM is an equity vehicle; SPU03 is the SP futures contract that expires in Sept of 2003; @ES.D is the EMini; mutual funds are vehicles; gold is a trading vehicle; etc.

This commentary is meant only for EDUCATIONAL PURPOSES. It is to help you see how a Technical Analyst reads the signs in the markets.

Stay sharp and on your toes. Moves can reverse on a dime, anytime. Let the market speak to you. If the market is going down, by golly ignore my commentary from the night before and know that the market is going down.

RULES OF THUMB:

0. I keep the chart in Figure 1a on each day's commentary simply to illustrate how much in tandem the 4 indexes I watch actually are. For this reason, I don't always comment on every index. Analysis of one speaks highly for the same analysis for each of the other indexes.

1. When price is pushing the upper Sunny_Bands upward and then eases off and moves back toward the midline, it's time to take profits. If it starts moving up and pushing on the Sunny_Bands again, it's time to get back in. Likewise, if the market is pushing down on the lower Sunny_Band and eases off to move back to the midline, it's time to take profits from the short play.

2. Divergence of the RSI and price is another good time to take profits and wait for a breakout of price before taking a position.

3. When the exchange puts in curbs or trading halts on a large move down, it usually (not always) stops the downward motion. After the market reopens is a good time to take profits from your short position.

4. The market can't go nowhere forever. Eventually, who knows how long it will be, there will have to be a breakout-- one direction or the other.

5. This commentary is for educational purposes only, and is meant only to teach readers about my indicators, other technical indicators, and how I read them.

==<:>==

While it may be true that a picture is worth a thousand words, it is definitely not true that a picture deserves a thousand words.