It is with great sadness that I announce that my esteemed colleague and dear friend, the famous and brilliant trader, programmer & author of "Using EasyLanguage 9.x" has died after a short battle with cancer. Please keep him and his wife Angela and their children in your thoughts. He will be sorely missed.

It is with great sadness that I announce that my esteemed colleague and dear friend, the famous and brilliant trader, programmer & author of "Using EasyLanguage 9.x" has died after a short battle with cancer. Please keep him and his wife Angela and their children in your thoughts. He will be sorely missed.

As my friend, I always wondered why Murray didn't correct people when they mispronounced his last name. He was Italian and the name is "Ru-gee-arrow" not "Ru-jair-ee-o" like everyone pronounced it. But, he never corrected anyone.

Obituary

Murray A. Ruggiero Jr., of Branford, CT, died June 19, 2021, at Yale-New Haven Hospital. He was the beloved husband of Angela Vigliotti Ruggiero.

Murray was born March 4, 1963 in New Haven, son of Murray Ruggiero, Sr. and the late, Joanne Vestuti Ruggiero, and grew up in East Haven, CT where he graduated from East Haven High School in 1981. In addition to his wife and father, Murray is survived by his children, Murray A. Ruggiero, III, and Jean Ruggiero, and stepson Anthony Vigliotti.

Murray went to Western and Southern CT State University receiving degrees in Computer Science and Physics Astronomy.

Murray was called "The Einstein of Wall Street" He wrote many books on systems trading and has a patent for "Embedding Neural Networks into a spreadsheet application." Murray was Vice President of Traders Management Consulting creating models and systems for institutional investment firms. He spoke at many conferences for trading as well.

Murray also worked with Cryptocurrency and blockchain technology. He was a consultant for the cryptocurrency called Neblio.

Murray was also a poker fan; he always said, "I always like playing against the best players in the world." Murray's biggest poker accomplishment was placing 65th in the World Series of Poker Circuit Main Event, Las Vegas NV with a heavily professional player field.

Relatives and friends are invited to a visitation Friday evening from 5:00 – 8:00 at the W. S. Clancy Memorial Funeral Home, 244 North Main Street, Branford and may attend his Mass of Christian Burial Saturday morning at 10:00 in St. John Bosco Parish at St. Mary Church, 731 Main St, Braford. Entombment to follow in All Saints Mausoleum, North Haven.

Murray's Works

Murray Ruggiero was a consultant for several institutional trading firms. He was one of the world’s foremost experts on the use of intermarket and trend analysis in locating and confirming developing price moves in the markets. He was a sought-after speaker at IEEE engineering conventions and symposiums on artificial intelligence. IEEE, the Institute of Electrical and Electronics Engineers, is the largest professional association in the world advancing innovation and technological excellence for the benefit of humanity.

Due to his work on mechanical trading systems, Murray had also has been featured on John Murphy’s CNBC show Tech Talk, proving John’s chart-based trading theories by applying backtested mechanical strategies. (Murphy is known as the father of inter-market analysis.)

After earning his degree in astrophysics, Murray pioneered work on neural net and artificial intelligence (AI) systems for applications in the investment arena. He was subsequently awarded a patent for the process of embedding a neural network into a spreadsheet, Patent number: 5,241,620.

Murray’s first book, Cybernetic Trading, revealed details of his market analysis and systems testing to a degree seldom seen in the investment world. Reviewers were universal in their praise of the book, and it became a best seller among systems traders, analysts and money managers.

He has also co-written the book Traders Secrets, with Adrienne Toghraie, interviewing relatively unknown but successful traders and analyzing their trading methodologies.

Murray was a contributing editor to Futures magazine since 1994, and has written over 160 articles. With almost 30 years of experience as a trading systems designer, Murray dug into the depths of niche and sub-markets, developing very specialized programs to take advantage of opportunities that often escape the public eye, and even experienced high level money managers.

Books

Cybernetic Trading Strategies: Developing a Profitable Trading System with State-of-the-Art Technologies (Wiley Finance Book 68)

"The computer can do more than show us pretty pictures. [It] can optimize, backtest, prove or disprove old theories, eliminate the bad ones and make the good ones better. Cybernetic TradingStrategies explores new ways to use the computer and finds ways to make a valuable machine even more valuable." --from the Foreword by John J. Murphy.

"The computer can do more than show us pretty pictures. [It] can optimize, backtest, prove or disprove old theories, eliminate the bad ones and make the good ones better. Cybernetic TradingStrategies explores new ways to use the computer and finds ways to make a valuable machine even more valuable." --from the Foreword by John J. Murphy.

Until recently, the computer has been used almost exclusively as a charting and data-gathering tool. But as traders and analysts have quickly discovered, it's capabilities are far more vast. Now, inthis groundbreaking new book, Murray Ruggiero, a leading authority on cybernetic trading systems, unlocks their incredible potential and provides an in-depth look at the growing impact of advanced technologies on intermarket analysis.

A unique resource, CyberneticTrading Strategies provides specific instructions and applications on how to develop tradable market timing systems using neural networks, fuzzy logic, genetic algorithms, chaos theory, and machine induction methods. Currently utilized by some of the most powerful financial institutions in the world — including John Deere and Fidelity Investments—today's advanced technologies go beyond subjective interpretations of market indicators to enhance traditional analysis.

As a result, existing trading systems gain a competitive edge. Ruggiero reveals how "incorporating elements of statistical analysis, spectral analysis, neural networks, genetic algorithms, fuzzy logic, and other high-tech concepts into a traditional technical trading system can greatly improve the performance of standard trading systems."

For example: spectral analysis can be used to detect when a market is trending earlier than classic indicators such as ADX. Drawing on his extensive research on market analysis, Ruggiero provides an incisive overview of cyber-systems—systems that, when applied correctly, can increase trading returns by as much as 200% to 300%. The author covers a wide range of important topics, examining classical technical analysis methodologies and seasonal trading, as well as statistically based market prediction and the mechanization of subjective methods such as candlestick charts and the Elliott Wave.

Precise explanations and dozens of real-world examples show you how to:

Most importantly, Cybernetic Trading Strategies takes you step- by-step through system testing and evaluation, a crucial step for controlling risk and managing money. With up-to-date information from one of the field's leading authorities, Cybernetic Trading Strategies is the definitive guide to developing, implementing, and testing today's cutting-edge computer trading technologies.

Traders' Secrets - Psychological and Technical Analyses: Real People Becoming Successful Traders (with Adrienne Toghraie)

Model studies of 14 successful traders

Model studies of 14 successful traders

Psychological & Technical Analysis: Real People Becoming Successful Traders

Traders' Secrets passes the two requirements for any book to become a classic&mddash;it combines crystal clarity with the original, insightful detail. Each chapter describes the methods of its interviews in precise detail. It further provides a psychological profile and context.

Too often trading books provide minimal generalizations about trading strategies and systems, and worse yet, negligible detail about all important trading psychology. Consequently, Traders’ Secrets is a fresh, original and valuable break from the norm in trading books. The interviewees in this book have been tremendously helpful and generous in describing their methods, systems, backgrounds and years of research. They come from a variety of backgrounds -fundamentalists, intuitive, technical analysts, stock, futures, commodities traders.

There is something for all traders in here. Modeling oneself on the success of others is probably the best way to success for oneself. Why wait to learn from your own mistakes when you can learn from the years of mistakes and successes of others? A feature of Traders’ Secrets Psychological & Technical Analysis I found particularly valuable was the interviewee profiles based on analysis and psychology. These ensure that no one should finish a chapter feeling they did not ‘suck the marrow’ from it and learn every single valuable lesson contained therein.

This feature of the book also amplifies its clarity and means the reader can test the systems for themselves and see what suits their own personality. It’s about time more trading books were written with a similar concern for the leader. The subtitle Real People Becoming Successful Traders only modestly hints at a vital feature of the book, namely that these interviewees are ‘real’, ‘normal’ traders who have proved successful. They are traders with whom the reader can more readily relate than if they were the Soros’s or Buffet’s of the world.

The traders in Traders’ Secrets Psychological & Technical Analysis probably make far better trading models than the big institutional traders or fund managers who employ whole research departments and Nobel Laureates to form their systems. (Although, I understand that Nobel Laureates can be a distinct trading disadvantage.)

The interviewees in this book, unlike some trading ‘wizards’ will not baffle the reader with fuzzy logic, artificial intelligence or undisclosed black box systems. The analysis used by these successful traders is open to all. In researching my own books, probably the most important lesson I have learnt from meeting and interviewing some of the world’s best traders is that there is no substitute for hard work, planning and self-discipline.

Trading appears deceptively easy, especially in a world of Internet brokers where online accounts can readily be opened. If you want trading success, your path will be shorter and more direct if you read this book.

Using EasyLanguage 9.x edited and formatted by Sunny J. Harris BUY NOW

Using EasyLanguage 9.x edited and formatted by Sunny J. Harris BUY NOW

The majority of professional and individual traders use some kind of trading software on which to base their strategies. With over 100,000 users, the most popular trading software today is TradeStation, published by TradeStation Technologies. While this software is favored by many, TradeStation's computer language can be confusing, especially for the novice.“Using EasyLanguage 9.x” is the new and highly updated version of several earlier editions familiarly called “the Putt Book.”

Previous editions were aimed at earlier versions of TradeStation (4.0 and 2000i) and were each best-selling TradeStation books. Sunny J. Harris author of "TradeStation Made Easy!: Using EasyLanguage to Build Profits with the World's Most Popular Trading Software" edited this book as well as wrote it's foreword.

“Using EasyLanguage 9.x” begins with basic concepts, leading you through learning TradeStation’s programming language, EasyLanguage. The book adroitly winds you into more and more intermediate topics, ending with several advanced topics, such as using text functions to place text on charts, drawing objects, activity bars, and probability maps.

Whether you want to code your own ideas or to modify code and concepts you have found in magazines and books regarding TradeStation, this book is a must have.The TradeStation code for this book is available for sale as a download on www.UsingEasyLanguage.com in addition to other free bonus code.

Real People: Real Traders with Adrienne Toghraie

Real People: Real Traders with Adrienne Toghraie

This book contains interviews with traders to whom you can relate.

They come from all walks of life - starting out as farmers, businessmen, educators, restaurant owners, scientists, house painters, aerospace engineers and salesmen.

They had to learn how to carve out a living from trading by relying on their own experiences, innate resources, and character, and now they all make a consistent living from their trading.

Combining analytical and psychological modeling studies of each trader and their strategies, this book is designed to help you determine what you need to beat the odds.

Murray was a true mensch. I never heard a bad word from him or about him. He was always loving and willing to extend a helping hand. Murray was my go-to man for all kinds of coding and trading questions. He was absolutely brilliant.

He was a great friend!

He is sorely missed!

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don't spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

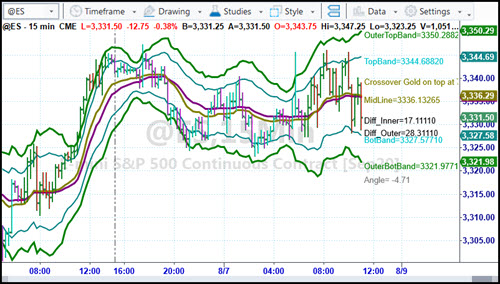

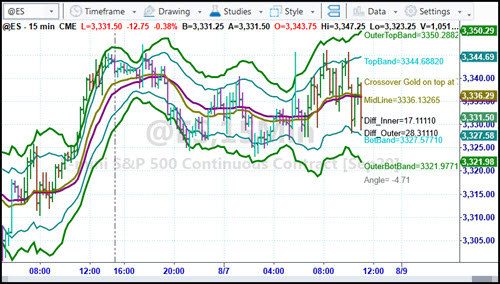

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don't spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.

NOW AVAILABLE: Live Trading with Sunny EVERY MORNING. (Trade Along with Sunny - TAWS) Want to see and hear how Sunny trades with SunnyBands? Listen to her reasoning and watch as she places trades. Here's your chance. Subscribe Here.

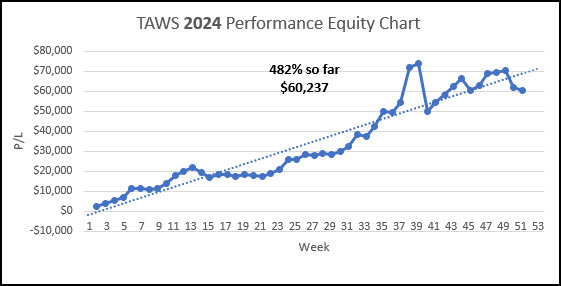

PERFORMANCE 2024 Year-End:

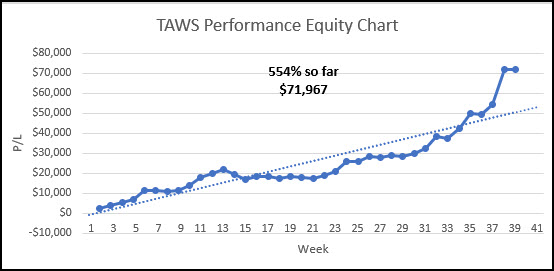

PERFORMANCE 2025 To Date

"Hi Sunny, wanted to share with you my profits for the day and say thank you! $19,412.50." -S. S., Mission Viejo, CA

"I wanted to let you know how helpful your daily trading room sessions have been. It is refreshing to see someone trade live and answer any questions that we have. It is so much better than a service that just wants to sell you something and send you on your way. This is really speeding up my learning and I look forward to trading along with you. Thanks for all you are doing to help people learn the art of trading." - Rick N.

"I had the fortune of meeting Sunny Harris and her excellent trade software SunnyBands. From the beginning, she gave me all her support, even though I didn't have any experience with day trade and English is not my first language she is always available for any questions. I tested SunnyBands free trial and the results were amazing $3.5K in the first week, I asked for another free trial and she was able to help me, I did it again, and after these records, I decided to buy the license for Sunny Bands. Thank Sunny for your unconditional support and your excellent software." -Juan R.

"I have studied swing and day trading for 10 years primarily with Gann methodology but I might be able to say I have studied it all. I lead a monk's life studying 12 hrs a day. I have found SunnyBands correlate to the high work of mathematics in price and one tool I treasure now for my chart analysis and trading. The first day I loaded SunnyBands I made $275 with one contract in about a minute; I thought to myself how can this small monthly fee not pay for itself? The opportunity to trade with such an experienced trader as Sunny is a real gift; the experience you will get in a year will be priceless. Doing this each trading day with Sunny will train your subconscious mind to become a consistent winner in the market. If you are thinking with a poverty mindset you will have a long hard road; don't do that. This is really awesome to be able to trade with each day and so appreciative of you doing this. To live trade as a mentor like you do is very hard and much respect and appreciation for you doing this Sunny!" - Arthur M.

"Well, I just want to say the I LOVE them !!!! ( your bands )....I've torn apart Bollinger Bands, Keltner etc, etc... and NOTHING comes CLOSE to what YOU have created.... :-) I've talked to CMT's who've said "oh yeah.... they're just Bollies".....and I almost spit out my coffee! I've watched your videos where you are walking a new customer through their use... and I "got it all" ( understood )... the "turns" are RIGHT THERE!.... Bollies are too general....and Keltner which Rashke says she likes....are only a hair better than Bollies.... YOURS blows both of them away.....of course YOU already know that." - Marius V.

The Podcasts of John Bolllinger, Steve Nison, Gene Inger, Hima Reddy, Brad Matheny, William Eng, Louis Navellier, Cynthia Kase, Howard Getson, Jake Bernstein, Arch Crawford, Henry Weingarten, Robert Pardo, Sherman & Tom McClellan, Stan Ehrlich, Steven Primo, Carolyn Boroden, Markus Heitkoetter, Dan Passarelli, Ted Hearne, Larry Pesavento, Norm Winski, Greg Morris, Larry Williams, Linda Bradford Raschke, Anka Metcalf and Robert Colby are now posted. Enjoy these great interviews. And after that whom would you like to see next?

You've had plenty of opportunites to watch how Sunny trades. There's the Live Trading Room, lots of Appearances, YouTube videos and Live Demos. If you have not yet been introduced to SunnyBands and how Sunny uses them, sign up here to get the Replay of the event.

WHAT ARE YOU MISSING?

Several features of Sunny Side of the Street are missing from previous issues. Natural Numbers, Scan of Stocks, DMA_H RS, PHW Scan, and more. What would you like to see me bring back? Comments.

HAPPY HALF HOUR! We will have the next HHH on Saturday January 4th at 1:15pm PT.Sam Tennis and I will be hosting the Next Free Networking Event for all Traders new and old to join in the discussion and "get to know each other" event. It's a great place to make new friends. Sign Up Here. This Free meeting of like minds will be held once a month, on the 4th of each month. We all have a great time and share liberally on the 4th of evey month. It's a lot of fun! Don't miss it next time. Click HERE to join us. You must be registered to get the invitation and link.

Free Live Demo Replay available Here.

If you would like to continue receiving this weekly newsletter every week, please SUBSCRIBE. It helps the cause.

FREE 7-Day Trial of Sunny's Most Powerful Indicators. Click Here. You have 7 (calendar) days to use it' full functionality and learn! I can only take 20 trials per month and all start on a Monday. Get your request in early.

EasyLanguage Forum Want to learn EasyLanguage (EZL) the EASY way? Here is the REPLAY (with video and slides). 5 1-hr lessons will take you through all the steps with Sunny Harris and Sam Tennis.

FREE 7-day Trial of Sunny's most Powerful trading indicators. Not sure about buying them? Take the trial. Most make enough during the Free Trial to cover the investment.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

The Definitive Guide to TradeStation's EasyLanguage & OOEL Programming--Vol I: Programming Guide and Vol II: Reference Guide

NOW AVAILABLE on Amazon.com.

Go to www.easylanguageooel.com, register as a Free Member and I'll send your FREE indicators wi th your proof of purchase