Sunny Side of the Street

Sunday May 23, 2021

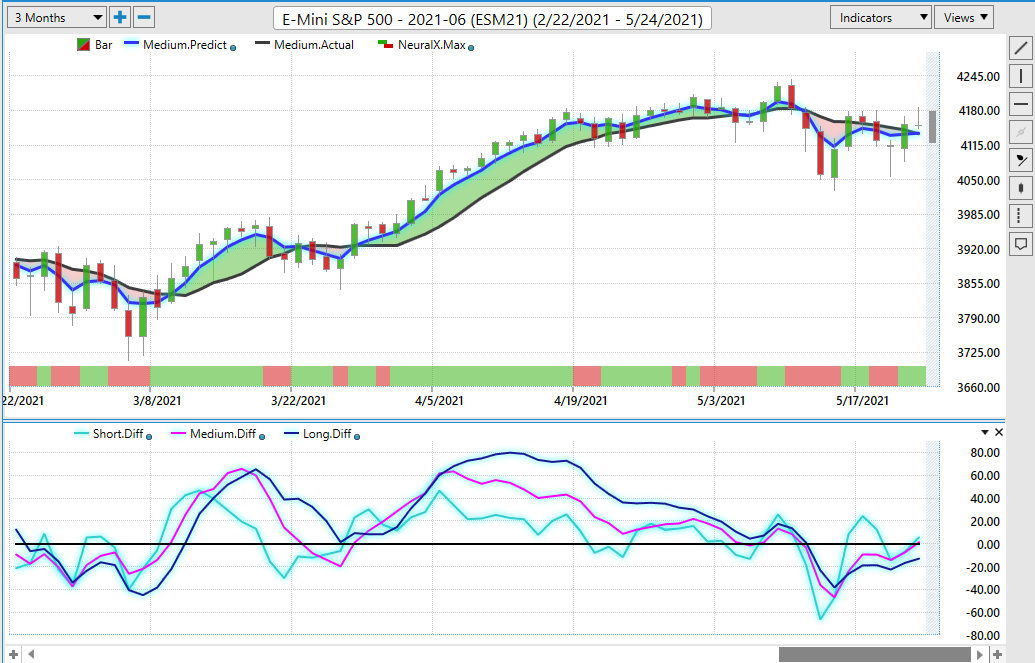

VantagePoint ai Prediction for Tomorrow

VP clearly projects the anticipated direction and magniture of tomorrow’s market. You can use any symbol; I trade the EMini S&P. My read of this clearly the market is poised for further move upward. All three moving averages are under the zero line and pointing upward, further confirmating the anticipated direction.

On my Facebook page (open Facebook and search for Sunny Harris) I post FREE predictions as well, often more frequently than Sunday nights. Who knows where the markets will really go, but it is elucitating to read the technicals and comments.

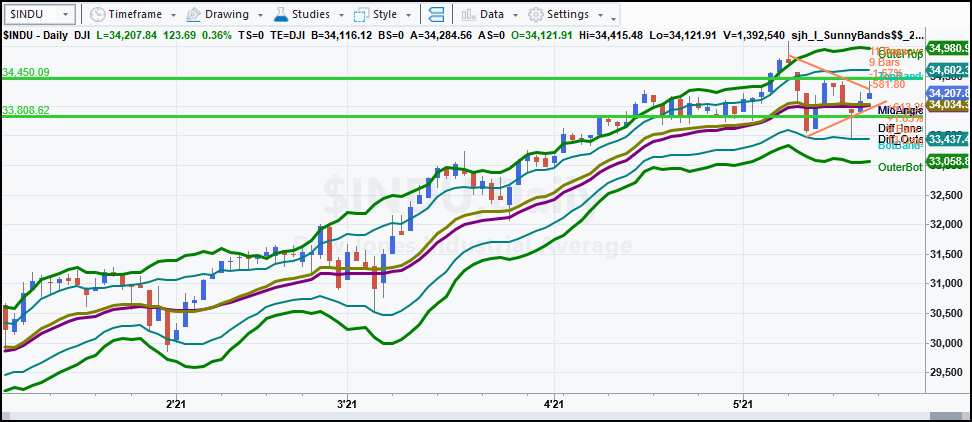

On 5/1/21 I posted: "I tho't the Dow would correct to 33,563. It beat that on 5/19/21 with a low of 33,473.80. The Fibonacci 61.8 extension from the March 2020 low is 33,329. We could still drop to that level. Note that SunnyBands lower-inner band was touched, but the move looks like it could correct to the lower-outer band at 33,053. Be wary.”

At this juncture I believe that the Dow will retrace back up to the 34,980 level, which is currently the top of the outside SunnyBands. VP suggests that tomorrow could be choppy, with it's gray line both above and below recent closes. It's very iffy right now with the Dow in congestion.

SunnyBands Implications

Dow Jones

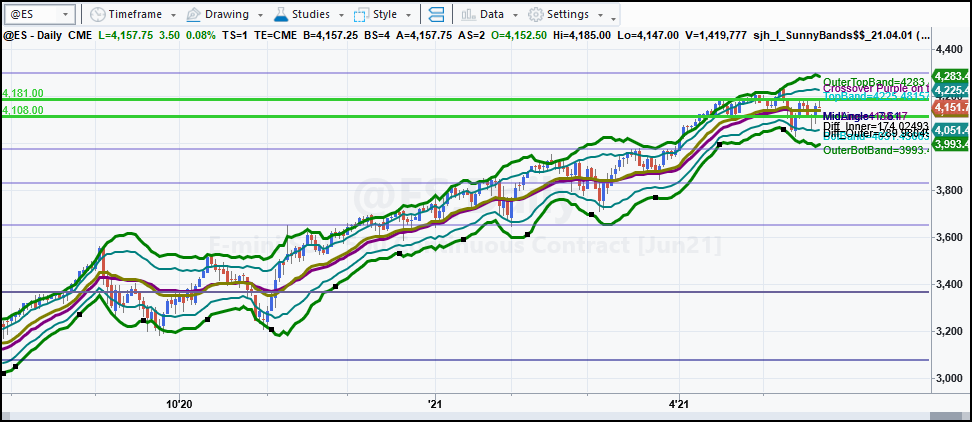

S&P 500

The first thing I notice ("What is true?") about these two charts is that each has stalled in its progression both upward and downward. We are in another congestion phase.

The ES hasn't been able to best its Highest(H, 5) and neither has the Dow. In order for the ES to continue the march upward it will have to pass the 4185.50 mark and the Dow needs to break 34,450.

The DMA (DynamicMovingAverage) is flat with purple barely on top, telling me that the sideways market is likely to open back upward in the near future. Price is holding right around the DMA and is not approaching either set of bands.

| S&P 500 Attractors |

|

Dow 30 Attractors |

|

|

|

The ES shows an Attractor at 4181 and another at 4108. (+/-) These are the areas that would have to be transgressed to establish a new direction.

The ES pennant formation shown above reminds us that if price breaks out to the upside it could start a new trend in the direct of the flagpole.

Today the high of the market pierced the flag, but the close did not. We are now still waiting for more evidence. |

|

The Dow shows an Attractor at 34450 and another at 33808. (+/-) These are the areas that would have to be transgressed to establish a new direction.

I also see a pennant formation stretching back to 5/10/21, which would say that the former direction would resume when the pennant is broken to the upside.

My guess is the market will break out of the combined pennant and attractor situation to the upside heading back up toward 35000.

|

Fibonacci Retracements and Extensions

Fibonacci extensions from the big "Covid Crash" can tell us a lot about where the market might be going. There is an extension at 4293 which gives us an upward target, and below we have another extension, this time at 3828. If the market continues to correct, then my lower limit is 3993 and if it melts up it could blast through the Fib Line at 4181.

Gold

Gold is on its way back up, from the looks of the weekly chart. The wave structure looks like a 1-3-5 to the top and a 5-wave A retracement with a simple B-wave move back up.

It looks like it should turn back to the 1808 level and then bounce up to the 2000 level but current activity suggests folks are anticipating inflation.

Bonds

Bonds are no longer continuing straight down. @US has taken a bounce at the 154 level and then retraced a good part of it. It seems that it wants to wiggle a bit more, testing support at the 154 level and then march on upward. That's conditioned on inflation continuing, as it has during the Covid year. It seems that everything one wants to buy is far more expensive than it was before Covid. And yet, I think it is under-reported.

If You Got this Free Newsletter from someone else and would like to Opt-In, and join us, click here.

Products

All subscribers to my Sunny Side of the Street newsletter are eligible for a 10% discount on any of my products. Call if you are interested.

Consulting/Mentoring - There is nothing that makes me happier than my students turning into great, profitable traders. I love to help new traders, and intermediate traders who are in a slump.

SunnyBands - SunnyBands are a extension of my DMA. The two lines above and two lines below the purple and gold DMA alert me to where the market is going. They are constructed from ATR bands on either side of the DMA.

DMA_H - Sunny"s DynamicMovingAverage in histogram format, using sophisticated math to smooth out the whipsaws.

I always welcome comments at sunny@moneymentor.com.

Click to unsubscribe.

Consulting Packages

Sunny has been teaching others to trade almost as long as she has been trading. Helping struggling novices over the hurdles is a passion of hers. Sunny has won awards for her teaching and consulting, being #1 in several categories. Sunny can teach you how to use TradeStation & MultiCharts and EasyLanguage and PowerLanguage, TC2000, VantagePoint, NinjaTrader, Genesis Navigator, and MetaStock so you don’t spend months struggling on your own. If you have a concept you want programmed, she can do it for you or teach you how to do it yourself. Click Here.

Strategies, Indicators & Custom Programming

We provide a wide range of software programmed by Sunny for her own trading. We are not a churn and burn shop that puts out lots of indicators for sale, just to have products to sell.

Each of these unique products is available to help others in their quest for profits. And, they are used by Sunny in her own daily trading. The software includes indicators that make trading smooth and easy, and strategies that can even be automated to provide hands-off trading. Click here for a full list, descriptions, charts and prices.